From Bloomberg, December 23:

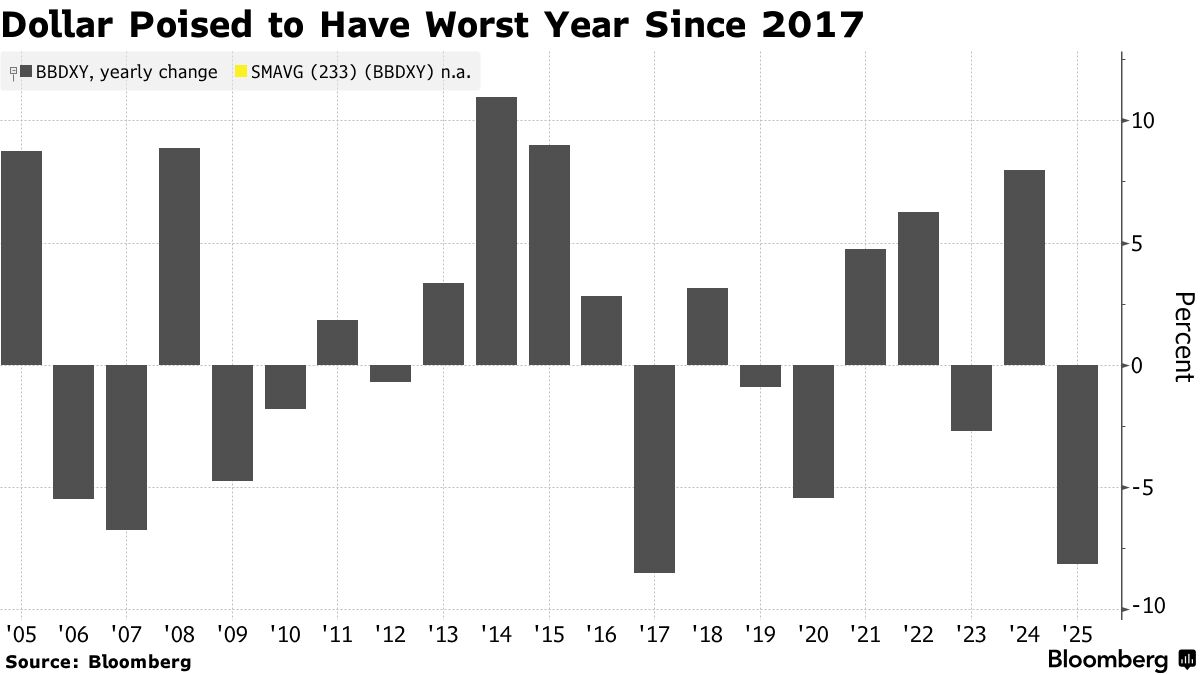

The dollar is heading for its worst annual performance in eight years, and the options market is signaling that traders are preparing for more downside in the final sessions of 2025 and beyond.

The Bloomberg Dollar Spot Index fell as much as 0.4% on Tuesday, touching the lowest since early October, before trimming its loss after a report showed US economic growth accelerated last quarter. The greenback index is down about 8% this year, putting it on track for its worst year since 2017, and the options market points to further declines in the coming months.

“My outlook outlook for 2026 is more continuation of the bear market, but a more modest one,” said Paresh Upadhyaya at Pioneer Investments. “The key risk to this view is US growth exceptionalism returning and today’s third quarter GDP highlights this risk.”

Expectations that Federal Reserve will lower borrowing costs further while many other major central banks are close to being done with their easing cycles have weighed on the greenback. A pattern of losses in December is also working against the US currency, which is down more than 1% this month.

Options pricing has turned more negative. So-called risk reversals, which depict market positioning and sentiment, show that options traders are the most bearish on the dollar in three months. Data from the Depository Trust & Clearing Corporation shows that the euro and the Australian dollar have been the main vehicles for expressing those bearish dollar views in recent sessions....

....MUCH MORE