And from Chris Skinner's The Finanser blog:Facebook is on the verge of launching its cryptocurrency next year, reports the BBC. Internally the currency is known as “GlobalCoin,” and the project itself is known as “Project Libra.” However, it’s not known if either of these names will be used as the currency’s name when it debuts to the public (hint: probably not).Facebook seems to be in advanced stages of planning the cryptocurrency, as the BBC reports that Mark Zuckerberg himself met with the Bank of England’s governor Mark Carney to discuss the opportunities and risks of launching a cryptocurrency. Facebook has also sought advice on regulatory and operational issues from the U.S. Treasury Department, suggesting the company’s cryptocurrency plans are in the end stages.

Facebook is also reportedly in talks with money transfer firms like Western Union, as it hopes to find cheaper and faster ways for people without bank accounts to send money abroad. Earlier this month, the Wall Street Journal reported that Facebook is also already in talks with some online merchants to accept the currency as a valid form of payment when it launches.

Of course, anyone who follows cryptocurrencies will know that virtually anyone can launch their own coin–it doesn’t take a company with the power or money of Facebook to do so....MORE

If Facebook launch a cryptocurrency, will US government shut it down?

I’m writing more and more about Facebook launching its own cryptocurrency lately:

This is because they are getting serious about payments and blockchain, after a variety of reports that they will launch their own stablecoin, available to two billion users for global payments. This is not to say that Amazon, Alibaba and others are getting boring – they are all also invested in payments and lending – but Facebook’s entry is a mixed blessing. On the one hand, as the Western World’s largest social network, it is important; on the other hand, as the Western World’s largest abuser of trust and privacy, it is challenged.

- Will Facebook become the world’s central bank? (March 2019)

- Will a global platform connect all of our money? (April 2019)

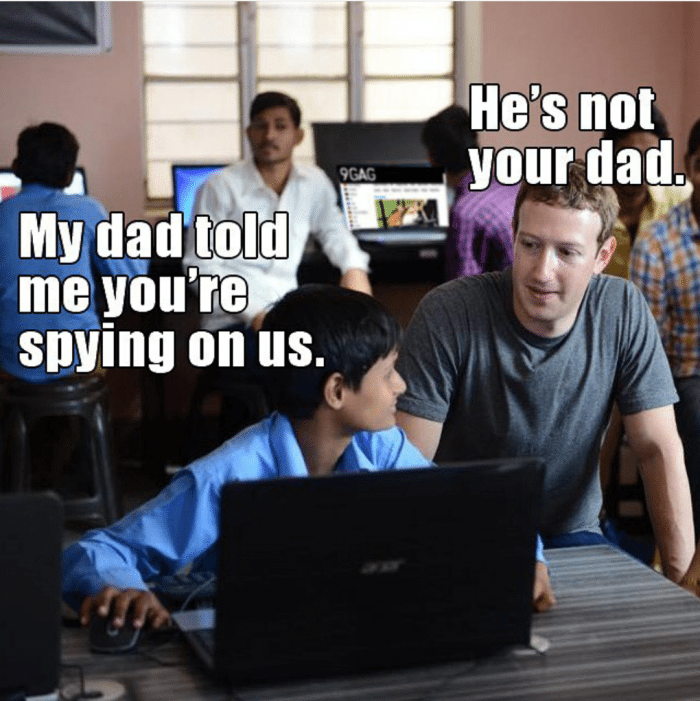

Gen Z kids graduating from university campuses are rejecting Facebook, after the Cambridge Analytica outcry, and my favourite meme always gets a laugh at conferences (because the audience knows it’s true).

However, providing a payments service using blockchain does not need trust in the same way as full-scale banking does, so they may succeed in this venture. Bear in mind, this is also not necessarily in Facebook as it can also be used in Instagram and WhatsApp, both owned by Facebook but seen in a different way as they are separate brands....MUCH MORE

Equally, it’s not so new. Facebook has had an EU e-money licence for five years, and has focused upon financial services for longer.

My view is that they’re not offering anything that’s a real threat to banks, as their largest advertisers are banks. Why would you cut the hand that feeds you? (Comment: the same is true with Google and AWS’s biggest users are banks, so same with Amazon) The threat is far more to payments firms like Western Union and foreign exchange firms. After all, if you can make seamless, frictionless, global payments via WhatsApp for free, why would you use someone else?...