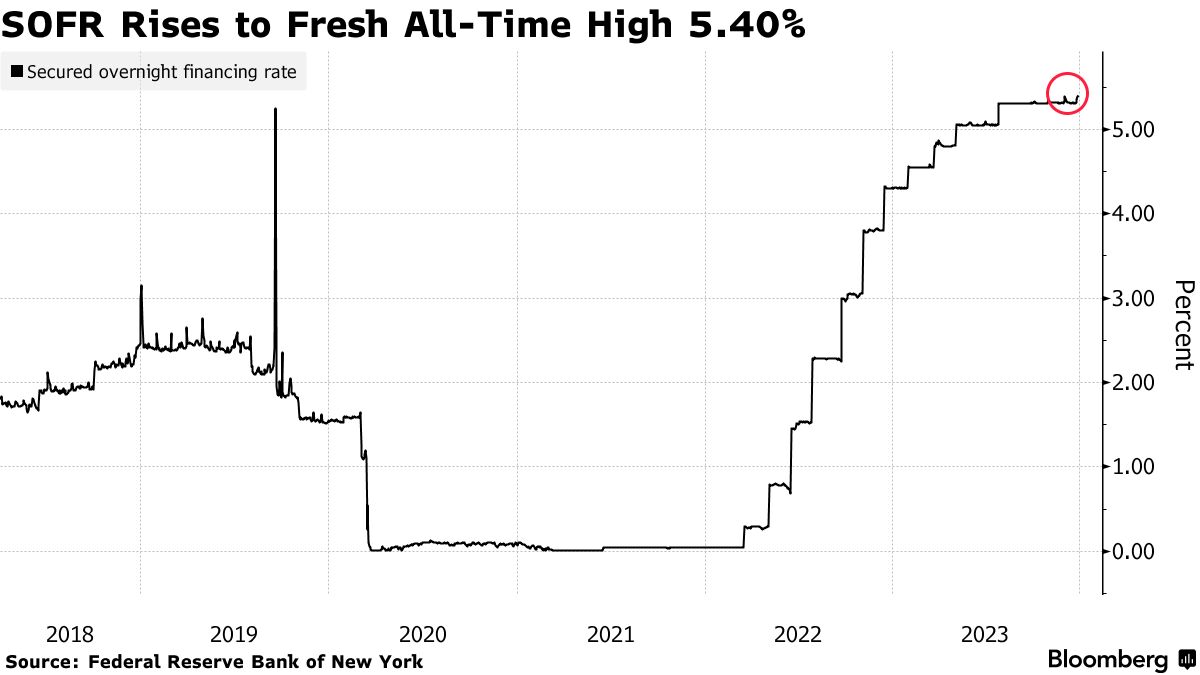

From Bloomberg, December 29:

- SOFR fixed at record of 5.40% on Dec. 28, from 5.39%: NY Fed

- General collateral repo now trading around 5.50%: ICAP

A key reference rate connected to overnight repurchase agreement transactions rose to the highest since the benchmark was introduced more than five years ago.

As volatility returned to the funding markets ahead of year-end, the Secured Overnight Financing Rate rose to an all-time-high of 5.40% as of Dec. 28, up from 5.39% a day earlier, Federal Reserve Bank of New York data published Friday show. That’s the highest fixing since the benchmark made its debut in April 2018.

Pressure in US short-term interest rates abated Friday following several days of year-end funding scarcity.

The rate on overnight general collateral repurchase agreements — a key metric for US funding markets — first traded at 5.625% at the open on the final trading day of December before dropping to 5.45%, according to ICAP. It has since climbed back to 5.50%. But that’s still lower than where repo rates for Dec. 29 were trading during the prior session.

Overnight rates typically move higher at the end of the quarter as some dealers curb activity in money markets to shore up their balance sheets. Traders have been on alert for additional pressure after repo rates surged last month following a sharp rally in US Treasuries....

....MORE

The next two months are going to get very interesting in Fedland and the money markets, we'll have more after the holidays.

Very related:

June 27, 2022: "The Federal Reserve's Explanation Of What Happened In The Money Markets In September 2019"

April 27, 2023: "Institutional Risk Analyst: The U.S. Banking System Has $5 Trillion Of Festering QE/QT Losses To Get Through"