Anything that has to be refinanced in the next 12 to 18 months will find the terms onerous compared to the late twenty-teens. Got a five-year note coming due? Yikes!

From Bloomberg via Advisor Perspectives, July 9:

Markets today pose a new existential question: Can there be a bubble in something if it has no price?

As a believer in efficient-ish markets, I am uncomfortable calling

anything a bubble. Recognizing a bubble requires spotting an asset or

asset class that is objectively overvalued before everyone else does.

Making this determination is almost always impossible in real time, even

if it’s screamingly obvious in hindsight. And that’s in public markets,

where prices are easily observed and constantly updated as investors

form views and incorporate information.

Sometimes, however, you get an inkling that something isn’t right —

and lately I am feeling that about private markets, especially private

equity, even if there are no prices that can collapse or be inflated.

There are several reasons to worry the private equity market is due

for some sort of reckoning. Over the last few decades, private markets

were flooded with money. Institutional investors — under pressure to

achieve high returns, especially in a low-rate environment — turned to

private markets that promised high future returns and attractive current

valuations (though these were impossible to verify or dispute). In

2023, the value of North American private equity assets under management

was estimated to be $3.5 trillion, more than 10 times what it was two

decades earlier.

Any asset class inundated with money often gets frothy, and for

private markets that means more investments that may not pay off. The

higher-forever rate environment poses an extra challenge, as the

industry thrived and grew with rates near zero. Some parts of the

private asset industry will weather higher rates, but others (commercial

real estate, for example) may not be able to. The question is how much

of a reckoning is coming, and how much damage will it cause?

“Everything is not going to be OK,” Scott

Kleinman of Apollo Global Management recently said. He compared the

private equity investments that won’t pay off to a pig being digested by

a python. In other words, investors will face fewer realizations and

lower returns.

There are reports of pension funds not getting the big payouts they

expected — or not getting anything at all, their money essentially tied

up in “zombie funds.” Some pensions are short of money and need to take

loans from the funds. Other pensions need to sell their stakes at a

discount on the secondary market....

....MUCH MORE

In Mid-May we linked to the American Sun's article: "

Private Equity, The Refi Crunch".

And one of my favorite PE posts, 2018's

"...Since 2006, Private Equity Has Produced Only S&P 500 Returns While Reaping $400+ Billion in Fees"

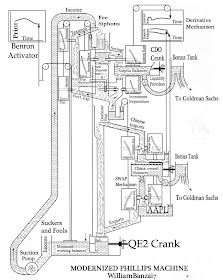

The discussion of hydraulic models of the economy in this morning's "If The FT's Izabella Kaminska Doesn't Start Posting To Alphaville...." reminded me of William Banzai's take on the Phillips model but with bonus receptacles and fee siphons:

Genius squared.from a post on GE's Mark I nuclear reactor at ZeroHedge!

which in turn reminded me of a story from Naked Capitalism that was in the queue:

August 7, 2018

Oxford Professor Phalippou: Since 2006, Private Equity Has Produced Only S&P 500 Returns While Reaping $400+ Billion in Fees....

Here's more on the Phillips model if interested (and who wouldn't be?):