Following on July 6's "Construction Commodities: Chinese Rebar Rolls Over".

From Macrobusiness (Australia), July 18:

Iron ore and steel turn falling comet

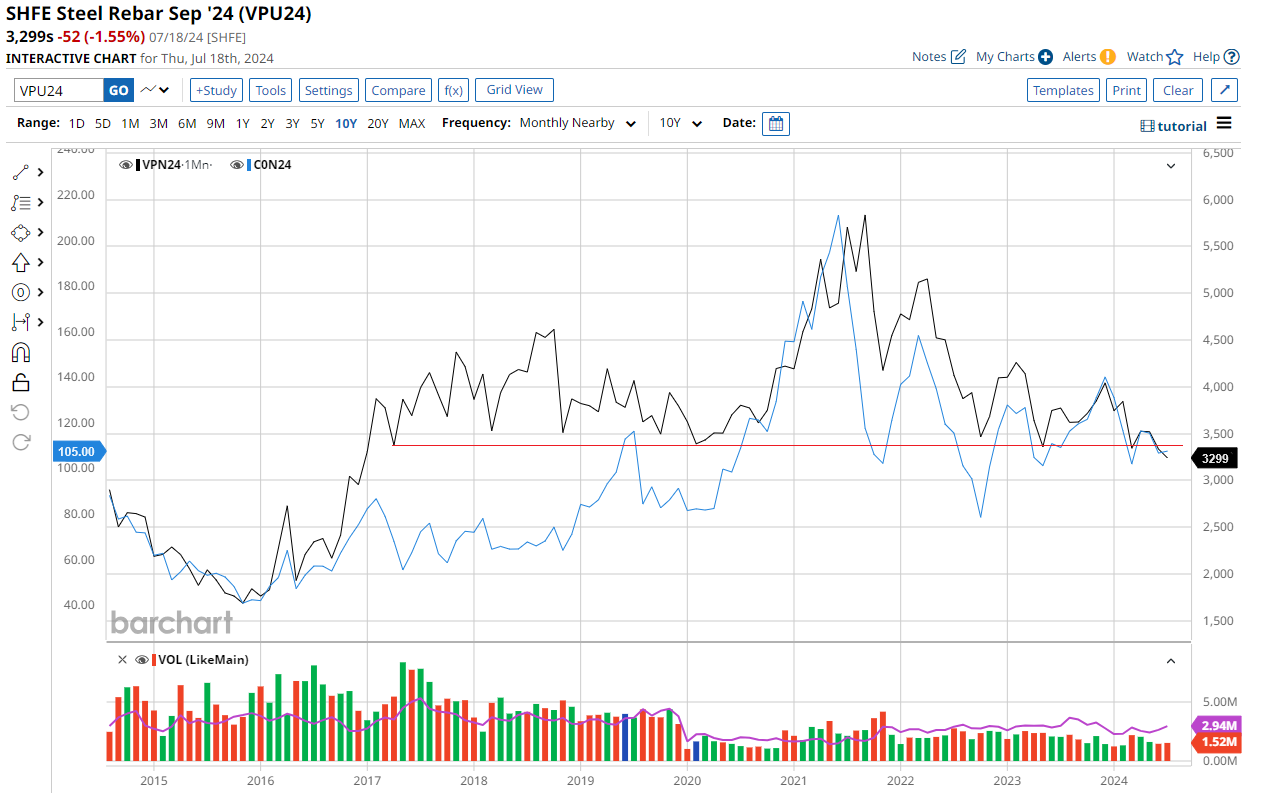

Shanghai rebar is howling that the FE complex is in deep trouble as it takes out seven-year critical support on the monthly chart:

The trigger yesterday was a meek Third Plenum statement:

At the session, an analysis of the present situation and the tasks we face was conducted. It was highlighted that we must remain firmly committed to accomplishing the goals for this year’s economic and social development. In accordance with the Party Central Committee’s decisions and plans concerning economic work, we will ensure effective implementation of macro policies, strive to expand domestic demand, develop new quality productive forces in light of local conditions, move faster to foster new drivers of foreign trade, take solid steps toward green and low-carbon development, ensure and improve the people’s wellbeing, and consolidate and build upon our achievements in poverty alleviation. We will review and assess the implementation of the 14th Five-Year Plan (2021-2025) and make sound preparations for the 15th Five-Year Plan (2026-2030).

It was stated that we must ensure both development and security. To this end, we will implement various measures for preventing and defusing risks in real estate, local government debt, small and medium financial institutions, and other key areas. We will make sure that responsibilities for workplace safety are strictly fulfilled and refine the measures for monitoring, preventing, and controlling natural disasters, especially floods. We will strengthen the network for preventing and controlling public security risks so as to safeguard social stability. We will improve public opinion guidance and effectively deal with risks in the ideological domain. We will properly respond to external risks and challenges, strive to play a leading role in global governance, and actively work to foster a favorable external environment.

That is not steel bullish, though next week’s Poliburo meeting holds out one last chance for more yawnulus. There was one ray of hope, from Bill Bishop:

In what seemed surprising, the Communique said that “an analysis of the present situation and the tasks we face was conducted. It was highlighted that we must remain firmly committed to accomplishing the goals for this year’s economic and social development.” So they are sticking with the 5% GDP target for 2024, and focus for any near-term policy adjustments should be on the Politburo meeting later this month, a meeting that usually reviews economic work of the first half of the year and tweaks policies for the rest of the year.

It will have to be big to save this market but I have my doubts, to put it mildly.

Steel inventories are high:...

....MORE, chartology

Quite a few speculators greet each attempt by the Chinese government to pump liquidity into the economy as a reason to drag out the 2010 playbook. But things change and if your thinking doesn't also change, you can get terribly surprised.

More succinctly (and more rhyme-y) the old Turkish proverb:

Or, as noted a half-dozen times over the last few years, in various forms and degrees of coherent expression (this from September 2023):

"Chinese Property Stocks Soar After Latest Beijing Support, Country Garden Debt Deal"

Once again we cautiously caution be cautious, that support for the group does not mean new construction (and the GDP growth it brings) is about to return to the glory days.

That time has passed, never to return and at best Beijing will keep the world from descending into a depression caused by the Chinese property market....

Also the outro from June 29, 2024's "China's Credit Impulse Loses Its Mojo":

Or:One of the oddest failures of analysis of the past two years is the apparent belief that Chinese central bank and government stimulus would do anything for future construction and thus demand for the inputs that go into construction.

They have their hands full just trying to mitigate a multi-trillion USD black hole of real estate that sucks up any money that comes near it....

December 14, 2022

China's $3 Trillion Shadow Banking Industry Pivots Away From Property Developers

This is one of the effects of the fact that the huge (eventually multi-trillion yuan) Chinese government effort to stabilize the property sector will not stimulate new construction. With all the implication for commodities that understanding entails....

Probably not related, September 2021:

"Attention: The Black Swan In The Center Of Beijing's Tiananmen Square Meant Nothing, Please Go About Your Business".