At the moment we are more interested in the broader Chinese market, proxied by the CSI 300 index, rather than individual names but here's a guy who was right once and may be again.

From Asia Times via MENA FN, February 20:

Wall Street these days is going to great lengths to avoid Chinese stocks. Michael Burry, for one, is bucking the trend, raising tantalizing new questions about whether the herd is getting Asia's biggest economy wrong after a nearly US$7 trillion stock selloff.

You would expect nothing less from a money manager who rose to fame in Michael Lewis's 2010 book “The Big Short.” In 2015, actor Christian Bale played Burry in Hollywood's take on a ragged assortment of players involved in the 2008 subprime crisis.

In that episode, Burry saw the coming meltdown - and the forces, blunders and institutions behind it - more clearly than virtually anyone. Those who invested with his Scion Asset Management in 2000 enjoyed returns of nearly 490% by 2008.

Burry is turning heads anew by betting big on China Inc at a moment when most investors are rushing for the exits. In recent months, Burry's firm made China's Alibaba Group its top holding and wagered on JD, too.

Filings show Burry's upped his stake in the e-commerce juggernaut Jack Ma founded by 50% in the year ended December 31.

The positions aren't huge - just under $6 million in each of Alibaba and JD. Yet the trades are bewilderingly at odds with the capital zooming away from China, including a tech sector plagued by regulatory chaos these last few years.

China's nearly $7 trillion stock rout since 2021 has largely drowned out discussions of contrarian bets or bargain shopping. Burry's China pivot is the exception, particularly because of the struggles facing both Alibaba and JD, whose shares are down 25% and 53% respectively over the last 12 months.

Along with China's regulatory risks and slowing economic growth, tech shares face headwinds amid fears about the nation's property crisis and the exodus of capital out of yuan assets....

....MUCH MORE

*Some of the Michael Burry headlines over the last couple years:

- 2021: "10 Times Michael Burry’s Market Crash, Other Predictions were Wrong"

- August 2022: "'Big Short' Hero Michael Burry Dumps Most of His Stock Holdings"

- March 2023: "'Big Short' Michael Burry admits he was 'wrong to say sell' after the Nasdaq 100 entered a bull market"

- August 2023: "‘Big Short’ Michael Burry’s market predictions: Hits, misses, and the reality"

- January 2024: "‘Big Short’ predictor Michael Burry clams up after doomsday prophecies never panned out"

So we shall see.

And ourselves? On December 27, 2023 we posted "A Bottom In Chinese Equities".

We were early. The Shanghai-Shenzhen CSI300 Index continued lower for another month.

Finally on February 1, the rat-bastard turned up with some conviction.

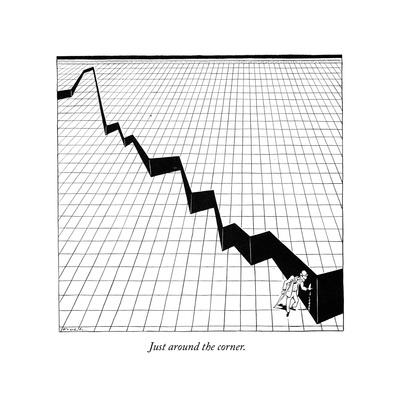

The hazards of bottom-calling were pretty much nailed by a cartoon we used as our guide and warning for readers, repeated some twenty-odd times in the six month crash during the 2008 -2009 unpleasantness: Alfred Frueh's January 16, 1932 New Yorker cartoon, "Just around the corner," playing off President Hoover's "Prosperity is just around the corner" exhortation:

The market finally bottomed on July 8, 1932, six months after the cartoon was published and 33 months after that all-time-high up on the upper left of the cartoon.

Bottom calling is hard.

And dangerous.