The Man Who Predicted The Collapse In Bond Yields Reveals What Happens Next: "There Is A Lot More To Come"

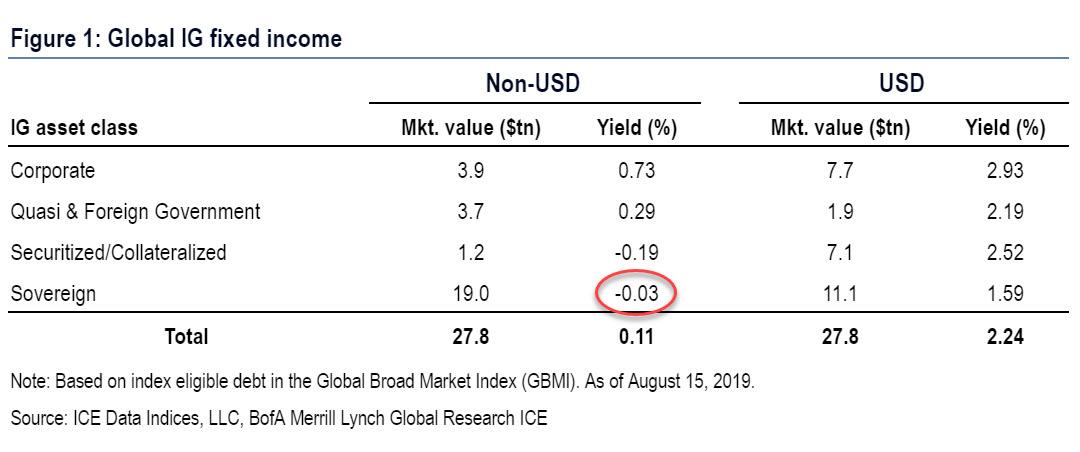

Earlier this week we wrote that after decades of waiting, for Albert Edwards vindication was finally here - if only outside the US for now - because as per BofA calculations, average non-USD sovereign yields on $19 trillion in global debt had, as of Monday, turned negative for the first time ever at -3bps.

So now that virtually every rates strategist is rushing to out-"Ice Age" the SocGen strategist (who called the current move in rates years if not decades ago) by forecasting even lower yields (forgetting conveniently that just a year ago consensus called for the 10Y to rise well above 3% by... well, some time now), what does the man who correctly called the unprecedented move in global yields - which has sent $17 trillion in sovereign debt negative - think?

In a word: "There is a lot more to come."

As the SocGen strategist - who is certainly not at all confused by the move in rates - writes, "investors are perplexed. How can government bond yields have fallen so low in such a short space of time?"

Although the tsunami of negative yields sweeping the eurozone has attracted most attention, yields have also plunged in the US with 30y yields falling to an all-time low just below 2%. For many this represents a bubble of epic proportions, driven by QE and ripe for bursting.Here Edwards makes it clear that he disagrees , and cautions "that there is a lot more to come."

What does he mean?

As Albert explains, "when you see the creeping advance of negative bond yields throughout the investment universe, you really start to doubt your sanity. For me it is not so much that 10y+ government bond yields are increasingly negative, but when European junk bonds go negative I really start to scratch my head." And as we wrote in "Redefining "High" Yield: There Are Now 14 Junk Bonds With Negative Yields", there certainly is a lot of scratching to do.

One thing Edwards isn't scratching his head over is whether this is a bond bubble: as he explains, his "own view is that this government bond rally is not a bubble but an appropriate reaction to the market discounting the next recession hitting the global economy from all overleveraged corners of the world (including China), with close to zero core inflation and precious few working tools left at policymakers’ disposal."

This means that "the bubbles are not in the government bond market in my view. They are in corporate equities and corporate bonds."

If Edwards is correct about the locus of the next mega-bubble, it is very bad news for risk assets as the "global deflationary bust will wreak havoc with financial markets", prompting Edwards to ask a rhetorical question:

Does anyone seriously believe that in the next global recession equity markets will not collapse? Do market participants really believe fiscal stimulus and helicopter money will save us from a gutwrenching global bust that will make 2008 look like a picnic? Has the longest US economic cycle in history beguiled investors into soporific complacency? I hope not.He may hope not, but that's precisely what has happened in a world where for over a decade, even a modest market correction has lead to central banks immediately jawboning stocks higher and/or cutting rates and launching QE.

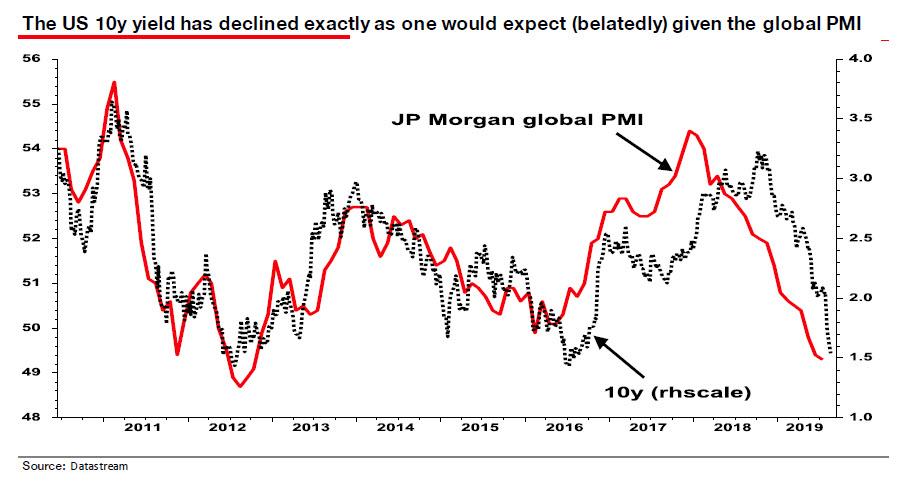

So to validate his point that the rates market is not a bubble, Edwards goes on to show that "US and even eurozone government bond yields are not in fact overextended – certainly not on a technical level – but also that fundamentals should carry government bond yields still lower."

...MUCH MORE

That chart also caught the attention of former Alphavillein Matthew Klein who, although not known as an Albert groupie (or any other type of groupie for that matter), did work with Master Murphy in the study of the arcane arts:

This is just a beautiful chart. Who knew the term premium tracks global economic conditions so tightly?— Matthew C. Klein (@M_C_Klein) August 23, 2019

ht @johnauthers pic.twitter.com/wKSslLr1co