FT Alphaville's Izabella Kaminska has been remarkably restrained.

If you read the comments on some of

her gold posts from 2012-2013 you'd come away with the impression she practiced some debauched puppies-in-a-blender Ilse Koch/Cruella deVil cultism.

Of course she did, from time to time, bait the gold-buggery crowd with headlines like "

Bricks of gold, bits of code: the worship of things shiny and useless" but overall she was fair, almost clinical in her examination of gold and the lovers thereof.

So having watched the over $500/oz. plummet from last December she must have been tempted to sneak in one little

told ya so, but she hasn't.

Me on the other hand, I'm probably not as circumspect....

Anyhoo.

In today's installment, "

How low can gold go?", she, without snark, says:

...This has now led a whole bunch of people getting excited about an upcoming bottom in gold, as well its prospective speedy revival.

But on the subject of gold bottoms, some bottom talk is more

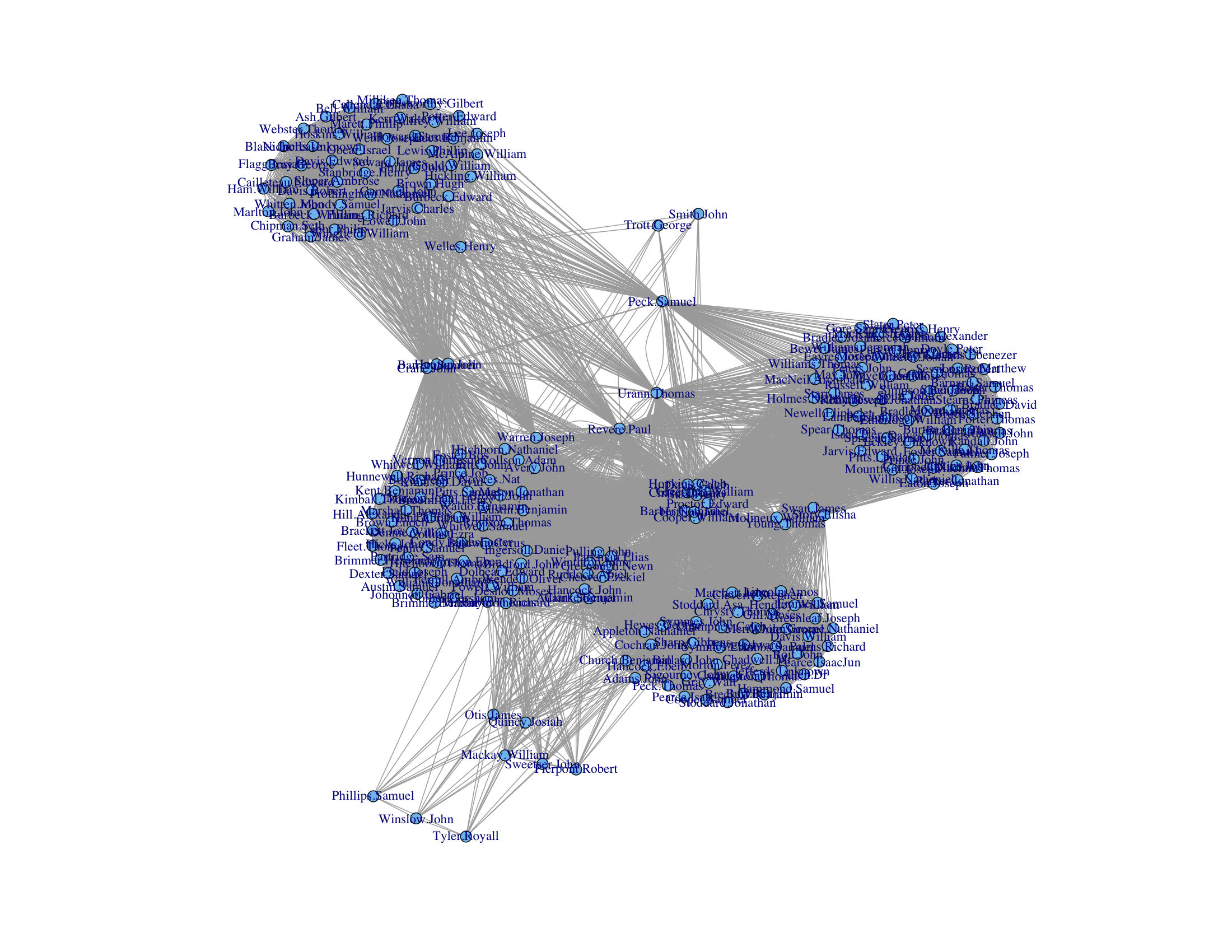

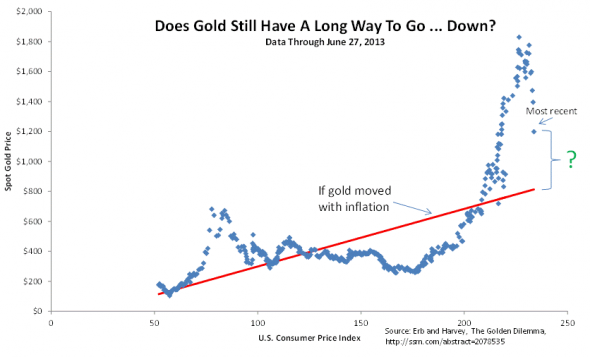

compelling than others. Campbell Harvey, from Duke University, for

example, has been arguing for a while that in real terms the gold price

has been overvalued for some time.

So, on the basis that gold really is the inflation hedge some people

think it is, its value should currently more about the … $800 mark:

But since gold doesn’t really do a good job of moving with inflation,

it’s hard to say if common sense valuations will prevail. In fact,

Harvey questions the entire correlation between gold and real yields,

and suggests its outperformance is mostly the result of a “fear trade”....MORE

The r-squared for gold and real rates is .82 (depending on the timeframe, of course)

And from Thompson Reuters' Alpha Now, the almost indecipherable (but nailed it) "

Gold price decline accelerates but may be oversold" (June 27):

The price of gold has accelerated its downward spiral since

June 20 and on June 26 marked its lowest level since August 2010.

Investors who had purchased the yellow metal as a hedge against higher

inflation have been squeezed out aggressively this year. But there are

indications gold is oversold.

On a long-term basis, gold has broken below $1,281/ounce, from the

38.2% Fibonacci of the uptrend between March 2001 and September 2011.

In the short-term, gold faces a downside target of $1,180/ounce from

the 1.236% Fibonacci projection of the downtrend between September 2012

and April 2013, and then at $1,093/ounce (1.382%).

Only a close above $1,281/ounce would signal that gold has formed at least a short-term bottom.

Source: Thomson Reuters Eikon

Source: Thomson Reuters Eikon Click through to enlarge.

Us?

We're targeting the 76.4% = $863.75 level.

$1213.30 last after an intraday bottom of $1179.40: