We are going to have a few posts on housing over the next couple days and will kick it off with this post from M&G's Bond Vigilantes, August 28:

Housing and the Fed – how low will rates need to go?

Central banks have traditionally relied on interest rates as a primary tool to influence economic activity, raising rates to cool down an overheating economy, and cutting rates to stimulate growth. Historically, these mechanisms have worked fairly well; however, the recent cycle has proven to be different. Despite a series of aggressive rate hikes, the expected economic slowdown has been surprisingly muted, suggesting that economies are now less sensitive to interest rates. This raises a crucial question: if recent rate hikes haven’t significantly slowed the economy, how can we assume that traditional rate cuts will effectively stimulate it? And just how low must rates go to have an impact?

The housing market serves as a key channel for monetary policy transmission, making it essential to examine how it has responded to recent rate changes. Historically, the transmission mechanism from monetary policy to the housing market, and subsequently to the broader economy, was straightforward (as discussed here). However, this mechanism has become less predictable, especially post-financial crisis (discussed here). This monetary mechanism is not working as normal due to the unique nature of the current housing market.

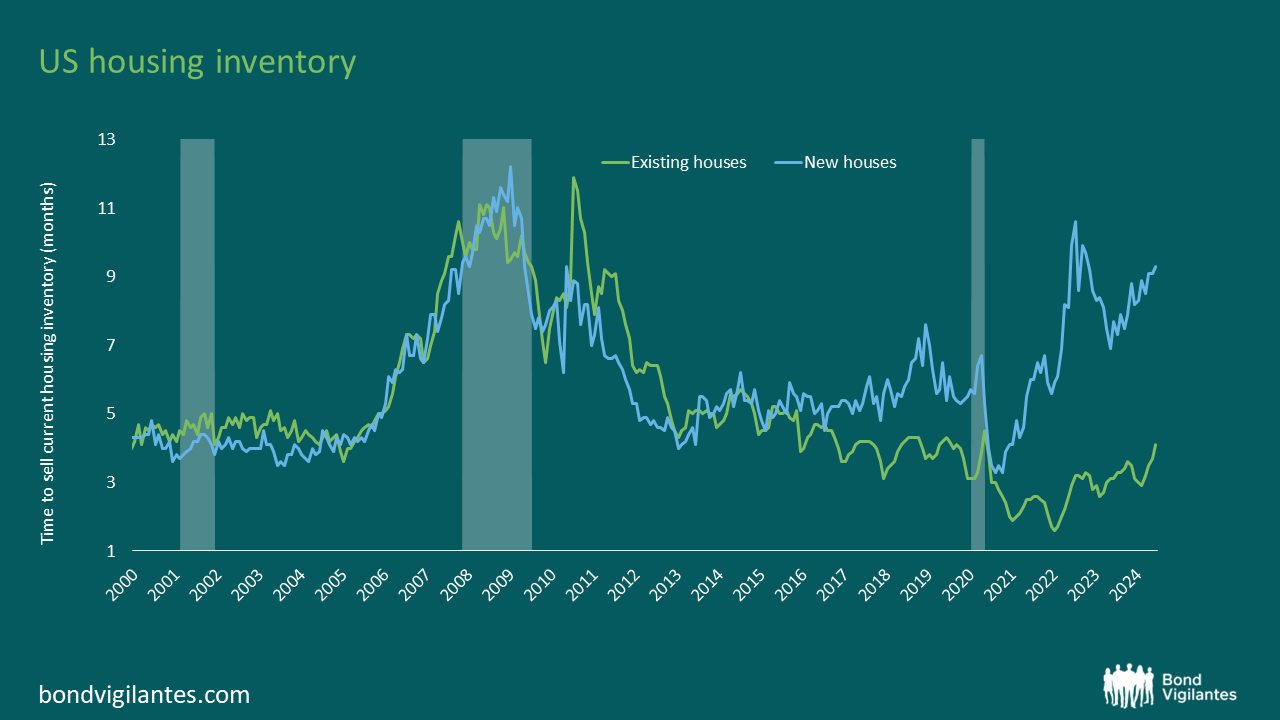

The strength of the housing market depends on the balance between supply and demand. The housing inventory chart below illustrates the current bifurcation in this market, showing a sharp divergence between the average time new and existing homes stay on the market, with the availability of existing home inventories remaining low due to homeowners’ reluctance to sell, while new home inventories have risen as affordability challenges deter potential buyers:

Source: M&G, Bloomberg, 30 June 2024

On one side, existing homeowners, who have locked in historically low mortgage rates, have little incentive to move, since doing so would mean giving up those competitive rates. On the other side, new homebuyers are willing to buy but cannot afford to, as elevated mortgage rates have made housing largely unaffordable for them.

We therefore need to understand what level of rates is required to restore balance in the housing market and stimulate activity again....

....MUCH MORE

There is a lot going on in this presentation with much of it being self-contradictory. Such is the state of a "market" untethered from market forces. It's all in the financing, and has been since 2009.