A twofer. First up, The Straits Times, February 8:

The global tremors from China’s property crisis are only just starting

Chinese investors and their creditors are putting up “For sale” signs on real estate holdings across the globe as the need to raise cash amid a deepening property crisis at home trumps the risks of offloading into a falling market.

The prices they get will help finally put hard numbers on just how much trouble the wider industry is in.

The worldwide slump triggered by borrowing cost hikes has already wiped more than US$1 trillion (S$1.35 trillion) off office property values alone, said Starwood Capital Group chairman Barry Sternlicht last week.

But the total damage is still unknown because so few assets have been sold, leaving appraisers with little recent data to go on.

Completed commercial property deals globally sank to the lowest level in a decade in 2023, with owners unwilling to sell buildings at steep discounts.

Regulators and the market are nervous that this logjam could be concealing large, unrealised losses, spelling trouble both for banks, which pushed further into real estate lending during the cheap money era, and asset owners....

....MUCH MORE

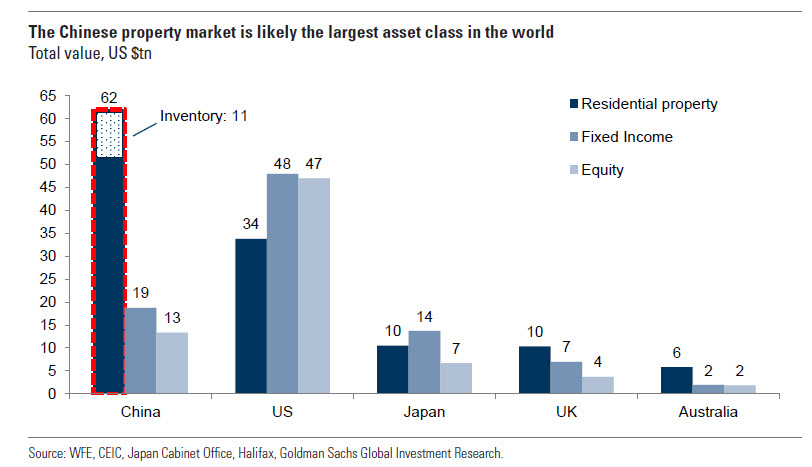

Here is a chart from Goldman in May 2021 that has been something of a lodestone for our thinking on China's economy since 2022:

Even accounting for the deflation of valuations since the grand reopening, the property asset class is still valued at some $35 to $45 trillion and of that amount a minimum $4 trillion and more likely $6 to $7 trillion will have to be written off. As the Chicago mobsters used to say, "That's a lotta loot, boss."

And from Wolf Street, February 5:US Office CRE Mess Is Spread Far and Wide across Investors & Banks Globally. US Banks Eat only a Portion of the Losses

Japanese, Canadian, and European banks started to confess. And for over a year, huge losses have hit investors, not banks.

What’s amazing about the mess of the office sector of commercial real estate (CRE) is just how far and wide these mega-losses – by some estimates, they may ultimately amount to $1 trillion, or whatever – are spread in diced and sliced form globally. Which is a good thing for US banks.

Some US banks have started to reveal the damage in bits and pieces and warn about office CRE loans. But foreign banks are also up to their ears in this stuff – Canadian banks, Japanese banks, European banks…. And some warnings have emerged. But a big portion of the office CRE loans are held by investors, not banks, and they have gotten the short end of the stick.

We have discussed this phenomenon here for a year – how the biggest office CRE losses haven’t hit the US banks as much, but have hit investors in Collateralized Loan Obligations (CLOs) and Commercial Mortgage-Backed Securities (CMBS) which are held in big baskets of relatively small slices by institutional investors, such as bond funds, pension funds, insurance companies not just in the US but around the world.

And losses have hit publicly traded and private property REITs and mortgage REITs whose investors span the globe; they’ve hit PE firms and hedge funds and other nonbank entities whose investors span the globe – to the point that we espoused the theory that US banks had been able to sell their riskiest worst office property debt, back during the “office shortage” when times were good and money was free, by securitizing it or selling it outright to institutional investors around the globe.

The delinquency rate of office mortgages that had been securitized into CMBS spiked to 6.3% by loan balance in January, having more than tripled year-over-year (up from a delinquency rate of 1.9% in January 2023), according to Trepp, which tracks and analyzes CMBS. This is a ferocious deterioration:....****.... The office CRE losses are split among lenders and landlords. Landlords lose their equity in the property – even giant landlords such as private equity firm Blackstone and private equity firm Brookfield have walked away from office properties.It’s the older office towers that are emptying out, or that have emptied out, that take the biggest beating. The latest and greatest office towers benefit from a flight to quality, as companies are abandoning older towers.

Lenders have lost between a substantial portion to nearly all or all of their loan value when they sell the office tower they’d seized via foreclosure or deed-in-lieu-of-foreclosure.

At the high end of losses was a 12-story, 50% vacant, old (read “landmark”) office tower at 300 W. Adams St., in Chicago, which recently sold for $4 million. This was the value of the building only – the “leasehold interest.” Land and building had been separated.

Alliance HP had bought the property for $51 million in 2012 and then divided it into a leasehold interest in the building and a 99-year ground lease. Alliance defaulted on the loan on the leasehold interest (the building). That loan had been securitized into CMBS, and the special servicer representing the bondholders then seized the building via a deed-in-lieu-of-foreclosure, and now sold it for $4 million. But Alliance HP still controls the ground lease, and still collects rent on it. No hard feelings, this is just CRE.

At the high end of losses was also the vacant 46-story office tower, built in 1985, in downtown St. Louis, which sold for $4.1 million in an April 2022 foreclosure sale, which after fees and expenses, left nothing for CMBS holders, and they took a 100% loss.

Now it’s the banks turn to confess.

So now the credit losses at banks are coming out of the woodwork.When the three regional banks collapsed last year – Silicon Valley Bank, Signature Bank, and First Republic – it wasn’t because of bad credit; it was because of their unrealized losses on their Treasury securities and MBS, whose market prices had tanked because yields had shot up, and uninsured depositors got spooked and yanked their money out all at once. These unrealized losses among all banks have exploded.

New York Community Bancorp [NYCB], which had bought from the FDIC some of the Signature Bank assets, caused a stir a few days ago when it disclosed a slew of issues: a Q4 loss, falling interest income, the new regulatory headache of having become a bank with over $100 billion in assets, and net charge off that rose to $185 million in Q4, mostly due to two loans, including, well, an office loan that had defaulted in Q3. And it has set aside $552 million in loan loss reserves to digest future loan losses, largely from its CRE portfolio. It holds $3.4 billion in office loans.

There have been and there will be other US banks to disclose in bit and pieces the issues in the office loan portfolios.

Oh, the foreign banks gorged on US office loans?....

....MUCH MORE