Market timing, communist style.

From ZeroHedge, December 1:

While US stocks are trading just shy of 2023 highs and less than 5% from all time highs thanks to the second best November performance since 1980, China is having big problems with, well, everything... but certainly its stock market.

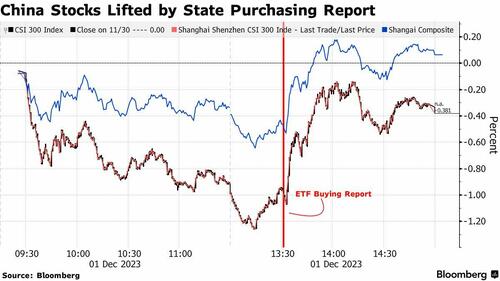

Overnight, Chinese shares slumped again, extending their recent underperformance versus global peers, when the CSI 300 Index was set for its lowest close since 2019 amid growing fears the relentless housing crisis will steamroll the economy, as a decline in home sales accelerated in November despite more funding support for developers.

Chinese losses were almost erased, however, and stocks rebounded in the afternoon after the China Securities Journal reported that the "National Team" was back in play, as an unidentified Chinese state institution bought exchange-traded funds whose underlying assets are A-shares issued by central state-owned enterprises in the domestic stock market Friday.

The news outlet didn’t name the institution. But after the markets closed, China Reform Holdings said in a statement that one of its units bought an unspecified amount of an ETF tracking the Guoxin Central-SOEs Technology Lead Index. According to Bloomberg, turnover for the China Southern CSI Guoxin Central-SOEs Technology Lead ETF also surged to around 10 times the daily average over the past three months on Friday, according to Bloomberg-compiled data.

As a result of Beijing's latest direct effort to prop up markets, the CSI 300 Index closed down only 0.4% after earlier falling more than 1% while the Shanghai Composite index ended in the green, bouncing back from a 0.6% slide that pushed it near the key 3,000-level that has in the past triggered intervention moves.

Stocks slumped earlier after data showed the decline in China’s home sales accelerated in November, while the latest Caixin PMI, which showed an unexpected pickup in a private gauge of China’s manufacturing activity, proved insufficient to ease fears about the economy’s recovery (and made more government stimulus unlikely)....

....MORE