First up, Yahoo Finance with an overview:

U.S. stocks tumbled Friday as the Federal Reserve's most closely watched inflation measure came in stronger than expected, in another sign that price pressures have become sticky into 2023.

The S&P 500 (^GSPC) sank 1.3%, while the Dow Jones Industrial Average (^DJI) plopped nearly 400 points, or 1.2%. The technology-heavy Nasdaq Composite (^IXIC) tanked 1.6%.

U.S. Treasury yields scrambled higher following the reading. The 2-year note surged 10 basis points to 4.8% while the 10-year note gained 7 basis points to 4.86%.

The Personal Consumption Expenditures (PCE) price index — the Fed's preferred assessment of how quickly prices are rising across the economy — rose 0.6% in January and 5.4% from last year. On a "core" basis, which strips out volatile food and energy components, prices rose 0.6% for the month and 4.7% from last year.

The report from the Commerce Department also showed that consumer spending rose 1.8% last month from December after falling the previous month.

The numbers support recent indications inflation is not falling at the pace and extent investors have been hoping for, even as prices have stabilized from the peaks of the current inflation cycle.

“First December CPI was revised higher, and now each reading for January surprised to the upside. Inflation’s like an old boyfriend or girlfriend that keeps showing up when you don’t want to see them," David Russell, Vice President of Market Intelligence at TradeStation said in a note....

....MORE

The cash Dollar Index (DXY) is up 0.61 at 105.20 after having traded at 101.04 on February 1st.

And from ZeroHedge, a deeper dive into rates and expectations:

Stocks & Bonds Slammed After Hot Inflation Print, Rate-Hike Odds Soar

A much hotter than expected Core PCE print has sparked a dramatic hawkish response across markets.

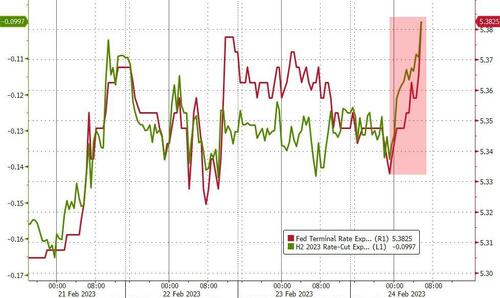

Expectations for The Fed's terminal rate has spiked to 5.39% and H2 2023 rate-cut expectations have dwindled to single-digits (just 9bps priced in)...

Source: Bloomberg

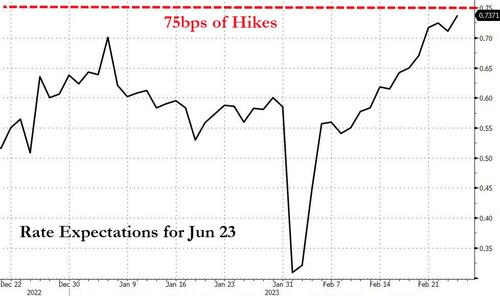

The market is now fully pricing in 3 x 25bps rate-hikes at the next three FOMC meetings...

With the odds of a 50bps hike in March now up at around 25% (and a 25bps hike fully priced-in....

....MUCH MORE (chart mania)