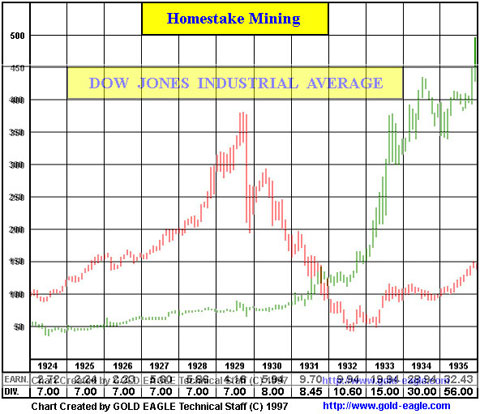

In the early 2000's I was asked to answer the question of gold's

performance during depressions, whether it was an asset to hold during

monetary deflation and I got to sort out the differences in performance

between gold backed money (or any money) and gold mining equities. The

most common example used by gold boosters is the action in Homestake

mining stock (HM NYSE) after the stock market crash in 1929:

So after Barrick bought Homestake, I procured an Indiana Jones hat and

ventured out to South Dakota to visit HM H.Q. in Lead (long 'e'), get to

know the librarians at the Deadwood Public Library and tramp around the

Black Hills. I was probably the last

person to look at HM's records from the 1930's, I was there as the

archivists were boxing the stuff up.

The short version of the stock action—and the dividends, look at that

bottom panel in the chart, $56 in 1935, basically what the stock sold

for a decade earlier, is:

There were three contributors to the move in the share price.

1) A

high-grading mining strategy proposed by a young engineer, Don

McLaughlin in the late '20's began bearing fruit in the form of higher

recoveries. Mr. McLaughlin went on to the presidency of the company.

2) A flight to safety after the October 1929 stock market crash.

3)

The Gold Reserve Act of January 30, 1934 raised the price of gold 69%,

from $20.67 to $35.00 (conversely devaluing the dollar by 41%).

3a) Homestake was thus paying salaries and other expenses in devalued dollars.

This

combination of more gold produced, higher price per ounce and lowered

expenses (in real terms) was what moved the stock, not some inherent

magic in gold.

(that's me quoting myself)

Which left me a lot of time to think about the hundreds of mines in the

neighborhood, the lack of secure storage facilities, the dangerous

nature of working in an area of steep gradients, heavy drinking and

gunplay.

(see Wild Bill Hickock in Deadwood's Saloon #10, August 2, 1876.)

and I realized "Holy crap, there must be a lot of gold buried here by

miners who went to town and never came back or fell down a shaft or just

forgot where they buried it."

Apparently this was also true in the earlier California Gold Rush (and for that matter every other rush.)

From the San Francisco Chronicle, June 9, 2019:

Granville P. Swift was known for many things, but he was not known for his memory.

The Kentuckian had come to California as a 19-year-old,

nine years before the Gold Rush would change the state forever. Young

Swift, whose great-uncle was the legendary explorer Daniel Boone, hoped

he would make his fortune in fur trapping — but he soon made his name as

an insurrectionist. In 1846, Swift was one of 33 Americans who captured

Sonoma during the Bear Flag Revolt. He stayed on in Sonoma for another

year, commanding a company and earning the rank of captain, before the

lure of wealth called to him again.

Upon the announcement of gold being discovered at

Sutter's Fort, Swift set off for Bidwell's Bar with a small party. He

struck it rich almost immediately.

"Swift was one of the best miners I ever knew," a fellow prospector said.

"It seems as if he could almost smell the gold. He made an immense

amount of gold. When these three men had worked all winter and fall, I

believe they must have made $100,000 apiece and maybe more."

According to an 1875 story in the Sonoma Democrat, Swift

left Bidwell's Bar with over half a million dollars in gold. He brought

it to San Francisco and had it minted into octagonal slugs, $50 each,

with a special mark designating them as Swift's.

Loaded down with gold — and without a banking system to

receive it — Swift decided to start burying his haul around the Bay

Area, primarily in the Sonoma area. The only problem was, he was very

bad at remembering where he'd hidden it all. Although Swift died in

1875, the secret died long before then, forgotten by the scatter-brained

settler.

Over time, some of the

gold was found. In 1903, a worker on a ranch in Sonoma County dug up

$7,000 in Swift's $50 slugs. A year later, $30,000 in gold was pulled

from a chimney hiding place on Swift's old ranch near present-day Sears

Point.

"While repairing a chimney on the second floor of the

place, workmen came across a secret receptacle containing $26,000 in

gold coin," the Healdsburg Enterprise reported. "In other places more

money was found, the total sum aggregating more than $30,000."

The biggest discovery came in 1914.....MORE

First posted June 16, 2019.