Industrial sector consumption of natural gas falls amid slowing economy

...The amount of natural gas consumed by the industrial sector in the United States typically rises in the fall and winter and declines in the spring and summer in response to changes in temperature-related heating demand. General economic conditions also influence industrial natural gas consumption. Higher demand for manufactured goods increases natural gas demand in the industrial sector.

Beginning in about March 2020, efforts to mitigate COVID-19 were implemented. Responses to the virus, including stay-at-home orders and temporary closings of nonessential businesses, contributed to a slowing U.S. economy. According to the Bureau of Economic Analysis (BEA), the value of goods and services produced in the United States, known as gross domestic product (GDP), decreased by 9.1% in the second quarter of 2020 compared with the same quarter a year ago. A slowing economy as a result of COVID-19 also affected GDP in the first quarter of 2020, which grew 0.3%. Last year, the U.S. economy grew 2.2%.

Source: The Federal Reserve Board

Industrial activity among industries that consume natural gas has also declined since the spring. Chemical, paper, primary metals, and petroleum and coal product industries account for nearly 75% of the natural gas used in U.S. manufacturing, according to EIA’s Manufacturing Energy Consumption Survey........MUCH MORE

Okay, that's a known known. Next up, OilPrice:with a bit of mystery:

Natural Gas Prices Plunge On Souring Demand, LNG Exports

Natural gas prices plunged on Monday by more than ten percent as the outlook for demand and LNG exports worsened as multiple Hurricanes caused disruptions in the U.S. Gulf of Mexico.....MORE

By 11:00 a.m. EDT, natural gas prices had fallen by 11.47% to $1.813 MMBtu.

Front-month natural gas futures (NG1) were at $1.829 MMBtu at 10:53 a.m. EDT.

Hurricane season in the Gulf has caused numerous disruptions to both natural gas demand and LNG exports, with Tropical Storm Beta the latest threat to the industry, with ships that would carry LNG avoiding the troublesome area for now, and likely the remainder of the week as Beta—like Sally—appears to be a slow-moving storm that will take most of the week to dissipate.

It is noteworthy that the November contract for natural gas is now trading at $2.684 MMBtu—a staggering $0.855 premium over the front-month contract.

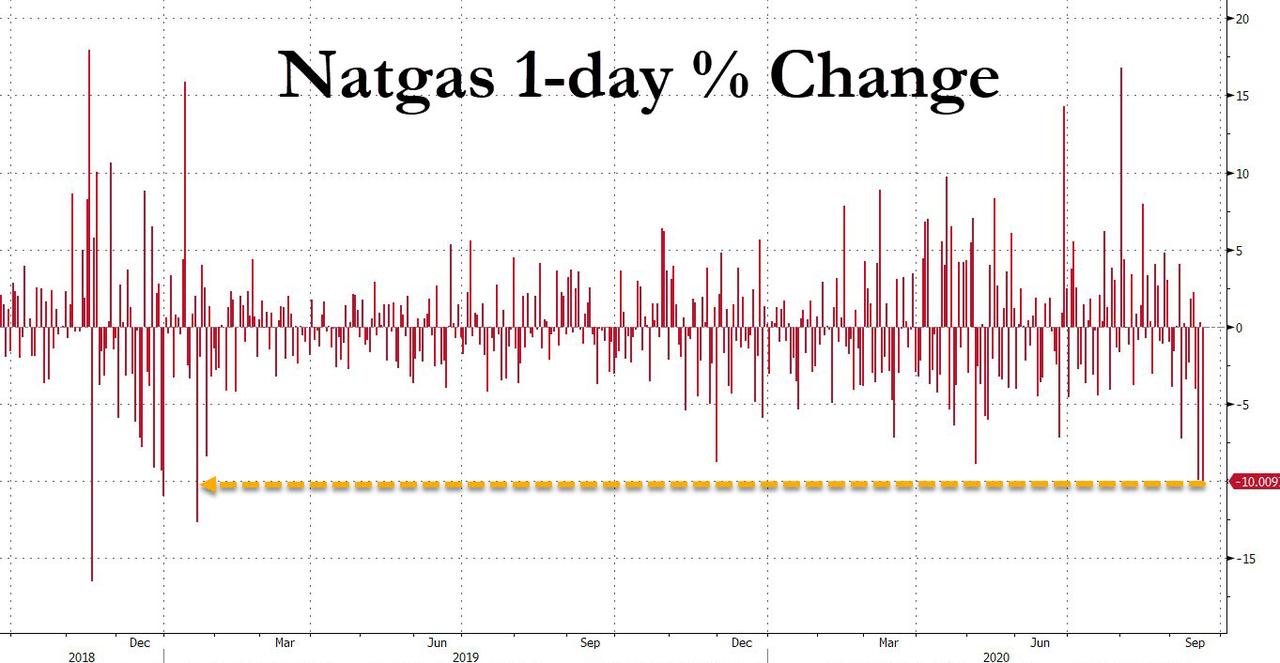

The fall in front-month contract natural gas prices is—so far—the most significant one-day drop over the last 21 months....

Finally, ZeroHedge with some commentary:

Nat Gas Plummets 10%, Slides Under $2 In Biggest One-Day Drop In 20 Months

Natural gas futures tumbled below $2 amid a broad rout in commodity markets and on speculation that Tropical Storm Beta may spur power outages and curtail LNG exports along the Gulf Coast (as Bloomberg notes, Beta is a slow-moving storm that will bring flooding rains in Louisiana as it toward Texas to come ashore near Corpus Christi).

*****

The day's 10% drop was the biggest since Jan 2019.

“Tropical Storm Beta is definitely a big driver,” says Christin Redmond, an analyst at Schneider Electric. "Although overall it’s a short-term effect, each week that we have this lower demand, we get higher storage injections. And with three storms hitting in less than a month, we’re getting those effects building on each other."

“Although it’s not hurricane strength anymore, it could cause significant flooding and may cause some LNG export facilities to temporarily shut in” Redmond added noting that these storms have resulted in 12% y/y losses in power demand for gas since start of Sept. At the same time, data provider Refinitiv added that the amount of gas flowing to U.S. LNG export plants was on track to slide to a two-week low of 5.2 bcfd on Monday from a four-month high of 7.9 bcfd last week.

As Bloomberg further observes, citing BNEF data, gas demand from power generators is estimated at just under 30 bcf for Monday, lowest for any Sept. 21 since 2015. Scheduled gas flows to LNG export terminals -33% from Sept. 18 to ~5.6 bcf on Monday....MOREPossibly related:

June 19

Uh Oh, Shades of Oil in Cushing: Natural Gas Storage at Henry Hub Close to Full

From the National Hurricane Center, the storm is forecast to get to the Texas Gulf coast, and rather than move inland it will follow the coastline to the northeast and then east along the Louisiana coast which is just strange.

Also at the NH, key weather discussions.

Front (October) futures 1.870 down 0.178