Elizabeth Warren is right to worry about private equity lootingWhich begins:

Sensible society would not allow these groups to rig odds as they gamble with economy

The US Democratic politician Elizabeth Warren recently published a piece of draft legislation with the eye-catching title of the “Stop Wall Street Looting Act”. Sounds a touch light-hearted? Well, actually it is deadly serious.

The “looters” in the title are private equity funds; specialist investors that buy companies using large amounts of debt. Once a minority activity, private equity has grown mightily over the past four decades on both sides of the Atlantic. As of 2017, there were around 8,000 private-equity owned businesses in the US. That is nearly twice as many as there were listed firms. Quite how this expansion has been accomplished lies at the heart of the story.A serious piece of reporting that garnered over 100 comments and which echoes some of our thinking on the efficacy of the Private Equity model.

Private equity executives insist their practices have spread because they run these companies better. That may be true in some cases — perhaps many. But there is a more questionable side to the buyout industry’s astonishing, Triffid-like growth. It stems from the way that private equity deals are structured. When buyout firms acquire a business, they fund the transaction primarily with borrowed money. This is then pushed down on to the portfolio company, which has to service those heavy debts....MUCH MORE

From June 2019's The Hidden Risks In Shorting Dogs:

One of the scariest concerns when shorting non-frauds in a bull market is that the very things that make a company a laggard and seemingly offer a tempting short—or the short leg of a pair trade—are things that attract the private equity vultures. This is why, for 2 1/2 years when talking about the mess that American packaged foods had become, we would obliquely, and sometimes not so obliquely warn:

March 7, 2017

M&A In European Food

And dozens of other posts with the same general tone.I'm not sure that consumer packaged goods is the area to be in, at least not in the U.S. and not based on names like Kellogg or General Mills.

For a quarter-century those manufacturers ratcheted prices as though they were tobacco companies but people find it easier to give up their Cheerios than their cigarettes.

The managements milked that approach for pretty much all it was worth so, as operating entities, they aren't all that attractive but someone will decide the only thing left to do is to asset strip or dividend recap the life out of the former cash cows.

Top o'the market to ya....

However, the latest wrinkle is even more frightening than PE messing with the economy.

From The Hustle:

What’s with the rash of private equity in dermatology practices these days?

According to a new op-ed from Joshua Sharfstein, former FDA deputy commissioner, more than 700 dermatology practices are now owned by private equity — a 12x increase from 2012 to 2017.

Per Axios, private equity providers have always gravitated toward more urgent health care — like ambulances — but skincare is wildly lucrative in its own right, and health care experts fear the PE derma-blitz could lance the growth of the industry in the long term.What...The....Hell?

Private equity: warts and all

The rise of these investments raises a lot of eyebrows over what a private equity firm’s grow-at-all-cost mentality will do to the dermatology industry — and the crater-sized blemishes that PE takeovers often form for companies once they sell.

Many financial observers tracked the Toys ‘R’ Us saga, and, ultimately, its demise, to the 2005 takeover of private equity firms — which generated large fees for the new owners while they slashed staff and reduced employee benefits.

Then there’s the unnecessary growth

According to Sharfstein, private equity firms generally aim for a lofty 20% return rate each year, which often involves a stop-at-nothing effort to increase revenues....MORE

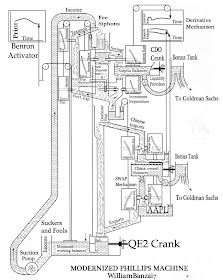

Speaking of the Private Equity model, here is sheer genius from William Banzai, last seen in

"...Since 2006, Private Equity Has Produced Only S&P 500 Returns While Reaping $400+ Billion in Fees"

The discussion of hydraulic models of the economy in this morning's "If The FT's Izabella Kaminska Doesn't Start Posting To Alphaville...." reminded me of William Banzai's take on the Phillips model but with bonus receptacles and fee siphons:

Genius squared.from a post on GE's Mark I nuclear reactor at ZeroHedge!

***Compare/contrast with the original:

"The computer model that once explained the British economy (and the new one that explains the world)"

From the New York Times:

Two weeks ago, while visiting Cambridge University, I arranged to have lunch with my friend Allan McRobie. He’s a professor of engineering, so it seemed a bit strange that he kept insisting we meet at the department of applied economics. “There’s something there you’ve really got to see,” he said in his Liverpudlian lilt. “It’s utterly fab. Just brilliant. The Phillips machine — it uses water to predict the economy.”...MORE

Schematic diagram of the Phillips machine. (Click to enlarge.)