From Alhambra Investments:

China’s economy is not crashing.

Hyperbole works both ways. Last year and this, the smallest increment

above a prior number was broadcast out as the greatest thing ever (US

wage growth in particular), irrefutable proof of globally synchronized

growth. Now that that’s over with, largely, there will be a tendency

toward the other extreme.

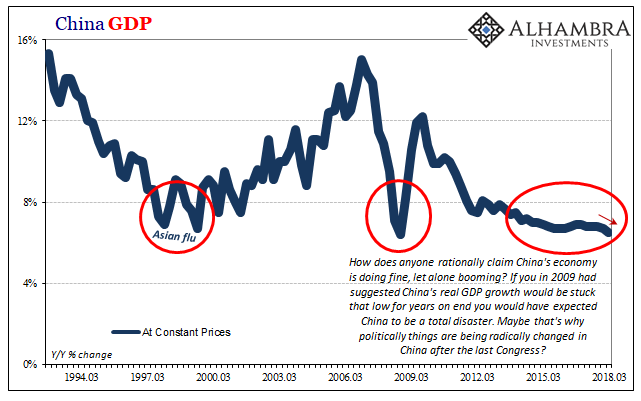

The latest Chinese economic statistics

are for several of them the lowest in some time. Starting with real GDP,

at just 6.5% in Q3 2018 it’s the slowest pace since the first quarter

of 2009. That’s not good especially for a statistic of such dubious

practices often specifically crafted to be the best it can be.

What that suggests is not immediate

catastrophe, offering instead more complete confirmation that this major

economy is slowing. Again. This is the real story in China and

therefore for everywhere else.

In other words, the real danger presented by these statistics is not imminent crash but rather the total disappearance of any upside potential.

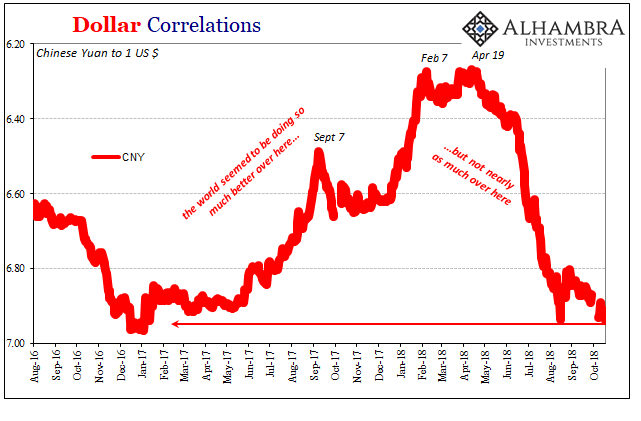

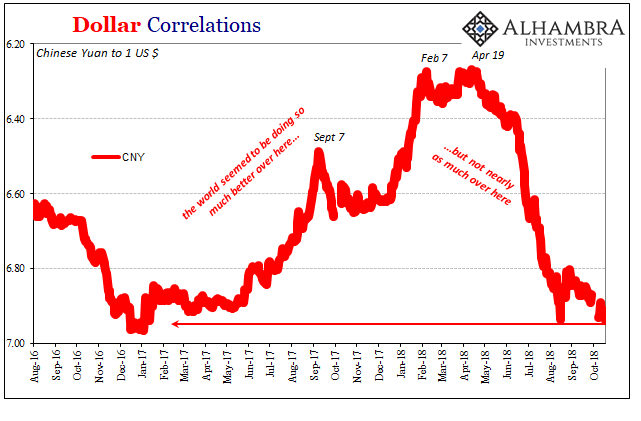

Even during 2017, the narrative about globally synchronized growth

continued as a future property. The global economy in that year was

clearly better than it was during the worldwide downturn 2015-16, easy

comparison, and that was expected only as the first step toward

meaningful acceleration and then recovery.

Where Economists and central bankers jumped the gun was in assuming that 2017’s improvement was the only

evidence they needed for those complete expectations. As it has turned

out, as it always turns out, changing from minus to plus signs is a

necessary condition for better days but not by itself a sufficient one.

Acceleration requires momentum among

other factors, and momentum is derived from conviction. The best days of

2017 never really had that, the absence perhaps clearest in China

(particularly the hollow rebound of CNY which “somehow” lacked “capital

inflows”).

Everyone kept waiting for the Chinese

to zoom on ahead and bring the whole up with them. Meanwhile, in China

they kept waiting for the rest of the world to take the lead so as to

pull them up out of their funk. That’s been the thing about “global

growth” since 2011, everyone expects that someone else will solve their

economic problems for them. Momentum will arrive, you see, it’ll come

from somewhere else.

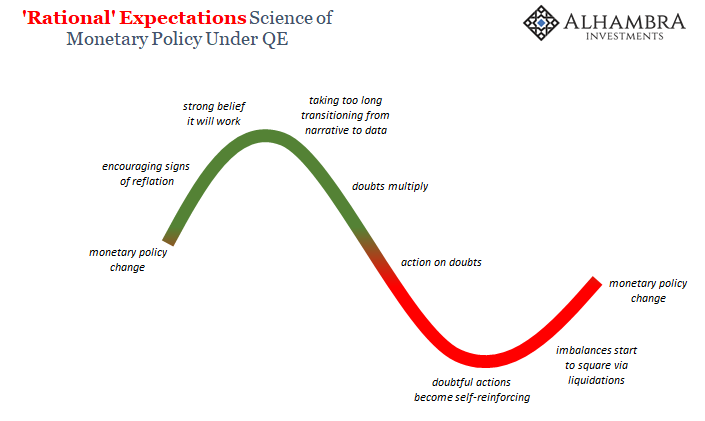

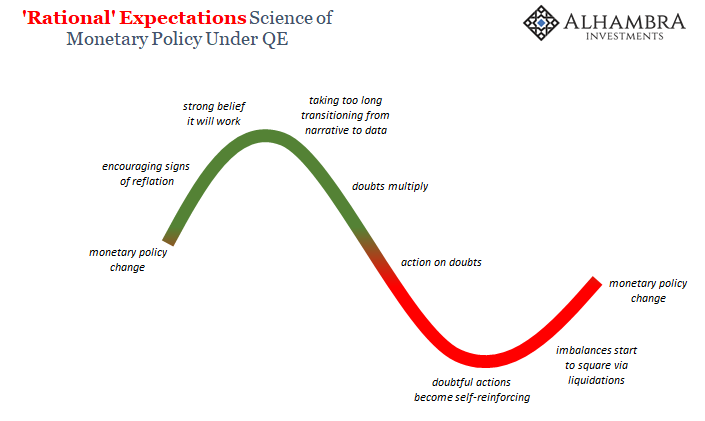

Without a clear path to that next step

toward recovery, doubts multiply rather than abate. What was for a time

mild opportunity, reflation, sinks back toward the malaise of liquidity

risks that over time can only return to self-reinforcing.

This is what’s significant about China’s numbers today. They practically declare reflation dead and gone. There is no upside left,

what you saw in 2017 was the best of it – and it wasn’t very good. It

was, in honest analysis, not really that much better than 2016 at all;

certainly less than the prior peak....

...

MORE