By raising the cost of capital, QT could tip the balance in favor of capital discipline.

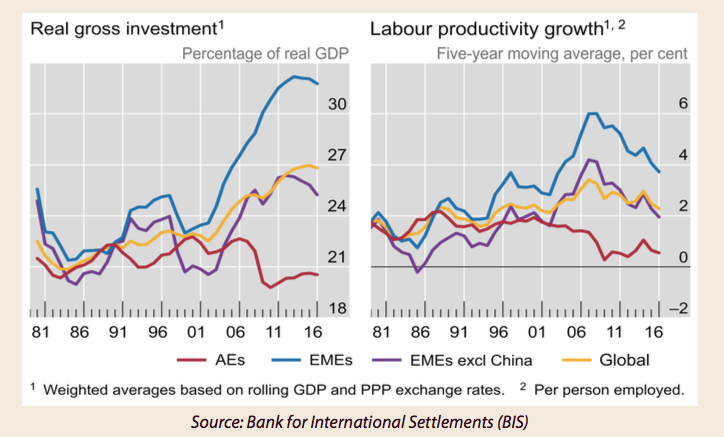

The answer to this question will be revealed gradually over the next couple of years, as the Fed gears-up for a gradual reduction in the size of its balance sheet and the ECB lays the groundwork for a tapering of its QE program. Suffice to say, the lowest interest rates in 5,000 years have done little to promote a pick-up in real gross investment or labor productivity in advanced economies (AEs), as the red lines in the following BIS charts illustrate.In WILTW June 23, 2016, we argued that much of the blame for this predicament belongs to the central banks: “If the Fed and other major central banks had not lowered interest rates to zero (or below), it would have been harder for corporations to justify financial engineering at the expense of capital investment. But, financial engineering goes hand-in-hand with management compensation practices that focus on short-term at the expense of long-term performance.”

QE did not drive U.S. price and wage inflation higher on a sustainable basis as central banks had expected. One of the frequent criticisms against QE is that the liquidity that was created remained largely within the banking system but did not filter down to the wider population who could spend it, which exacerbated income and wealth disparities. Hence, asset prices such as stocks, bonds and real estate rose, but broader measures of price and wage inflation lagged. Another criticism of QE is that it led to inefficient capital allocation and mal-investment in the commodity space, among other sectors, which was deflationary.By raising the cost of capital, QT should result in more efficient capital allocation and less mal-investment across the commodity space, which previously caused a drag on the CPI. This should result in an inflationary impact in the energy sector, restraining supply growth in shale oil by curtailing the supply of cheap finance. Halliburton’s (HAL, $43.32) executive chairman, David Lesar, recently said that a “tapping of the brakes is happening all over North America” and earlier this week, Anadarko Petroleum (APC, $45.17) announced that it would cut $300 million from its capex budget for the remainder of this year.Will others follow? Only time will tell, but the higher cost of capital triggered by QT could tip the balance in favor of capital discipline. Crude oil prices appear to have bottomed-out, and if Anadarko’s move is copied by others and capital discipline returns to the shale oil patch, oil could rise farther and faster than anyone currently expects.Higher capital costs will also affect supply-growth in the agriculture space, and this could be compounded by adverse weather and tighter supply of migrant labor — all of which could push food prices higher. Global weather has been uncharacteristically benign in the past five years. That period may be ending — ushering in higher food prices — as we have seen in the nearly 35% rise off the lows in wheat prices and poor growing conditions in soybeans.If QT results in a sustainable rise in the cost of capital, the U.S. federal and state budgets will get squeezed, which will lead to a vicious cycle of higher taxes and/or spending reductions, which could push interest rates up even further. We have made the following point often but it bears repeating: according to the latest baseline budget estimates by the Congressional Budget Office (CBO), federal net interest expense could double from $240 billion in FY2016 to $481 billion in FY 2021, even though the average interest rate on publicly-held debt is assumed to increase by less than 100 basis points.

Further QT could trigger a weaker U.S. dollar, which would, counterintuitively, put upward pressure on consumer price inflation. A November 2, 2015, study by Harvard’s Gina Gopinath estimated that “a 10% depreciation of the dollar relative to its trading partners will raise cumulative CPI inflation two years out by 0.4–0.7 percentage points.”...MORE