From Risk Reversal:

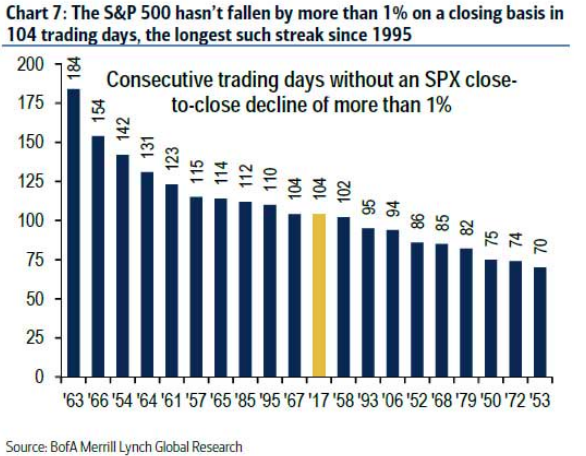

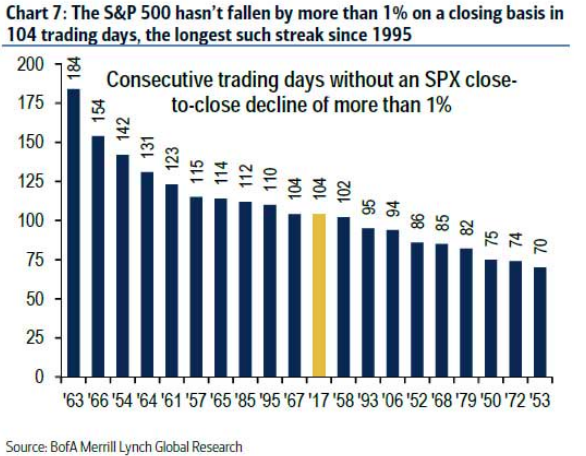

Yesterday marked the 105th consecutive trading day without a one percent

drop on a closing basis. Here’s how that ranks among other streaks

(from BoA/ML on Tues, h/t Zerohedge):

As you can see, the current streak is

working its way up the historical list. Just a few more calm days and

the current streak can pass one of 110 in 1995 and one of 112 in 1985 to

become the longest such streak in 50 years!

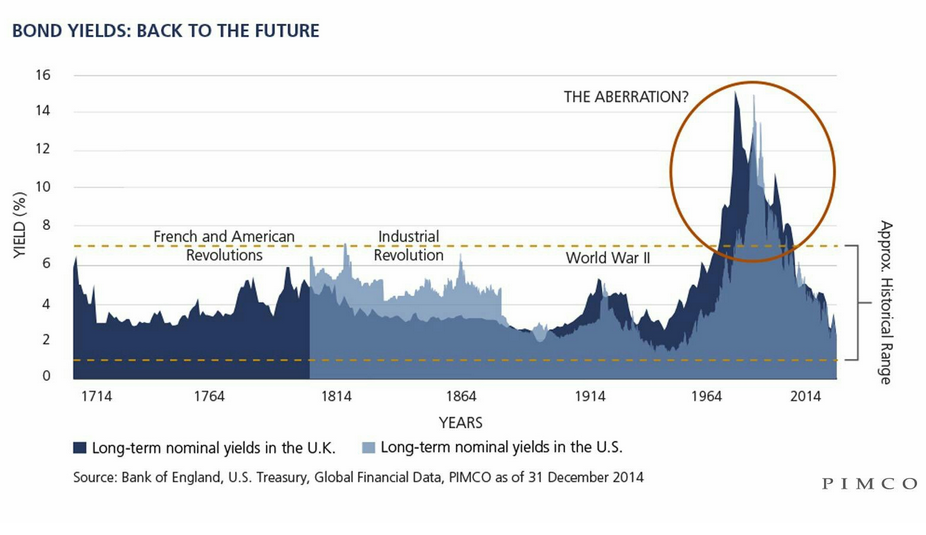

Obviously, this lack of fear in the market

flies in the face of what’s going on on the ground, with an FOMC and

other central banks about to raise rates and remove accommodation in

their most significant form since the Great Recession. Political

upheaval in Washington, with tons of uncertainty on tax, healthcare,

infrastructure spending, immigration and trade policy. And of course

geopolitical uncertainty overseas as the EU is under threat from Brexit

and upcoming elections in France (they dodged a bullet in the

Netherlands) and then Germany, as well as a US President and his special

advisor that have called into question the need for transatlantic

military alliance NATO.

So how is the market able to to shrug off

all of this and climb a wall of worry? For some, most of the reasons

listed aren’t huge threats. NATO was a cold war era alliance, the EU was

designed to fail eventually, the populist part of the new President’s

campaign was always a con and the policies actually being implemented

are classic market friendly deregulation and tax cuts. No big deal for

markets, no reason to panic. And most importantly, just how scared

should we be that rates are about to rise? And more importantly, how far

will they go?

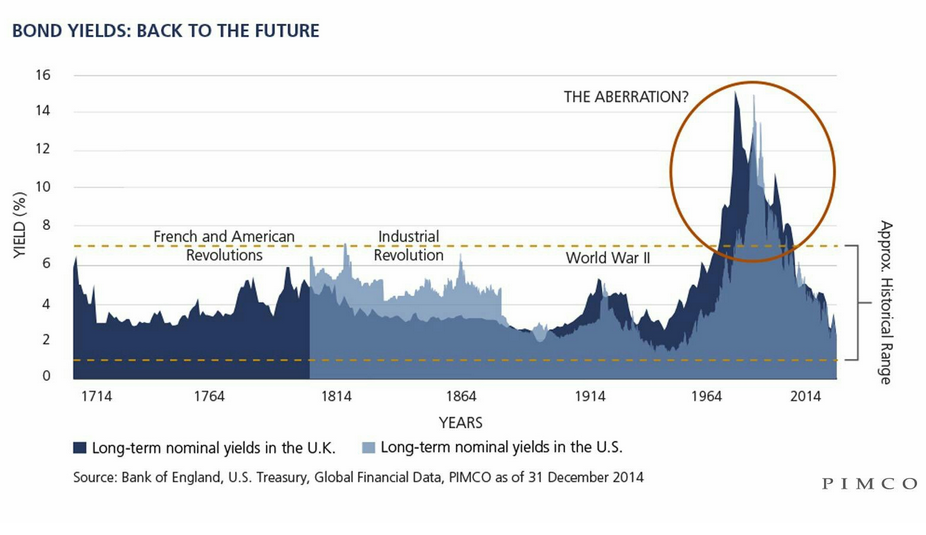

Here’s an interesting chart from Pimco (h/t ):

...MUCH MORE