What's to crack down on? With $35 TRILLION in assets wearing the ESG label I had assumed all of our E to the S to the G problems were solved and Nirvana was just around the corner..

(actually it's probably just regulatory capture by BlackRock: they want to be the sole determiner/arbiter of who gets the label)

From ZeroHedge:

If it wasn't already abundantly clear that ESG investing has become one of the hottest investing crazes of the new decade, Cathie Wood's announcement earlier this week that she had applied to the SEC for permission to launch an ESG-focused ETF - the fund will exclude alcohol, banking, chemicals, confectionary, tobacco, oil and gambling stocks, among others - should stand as a rather obvious confirmation.

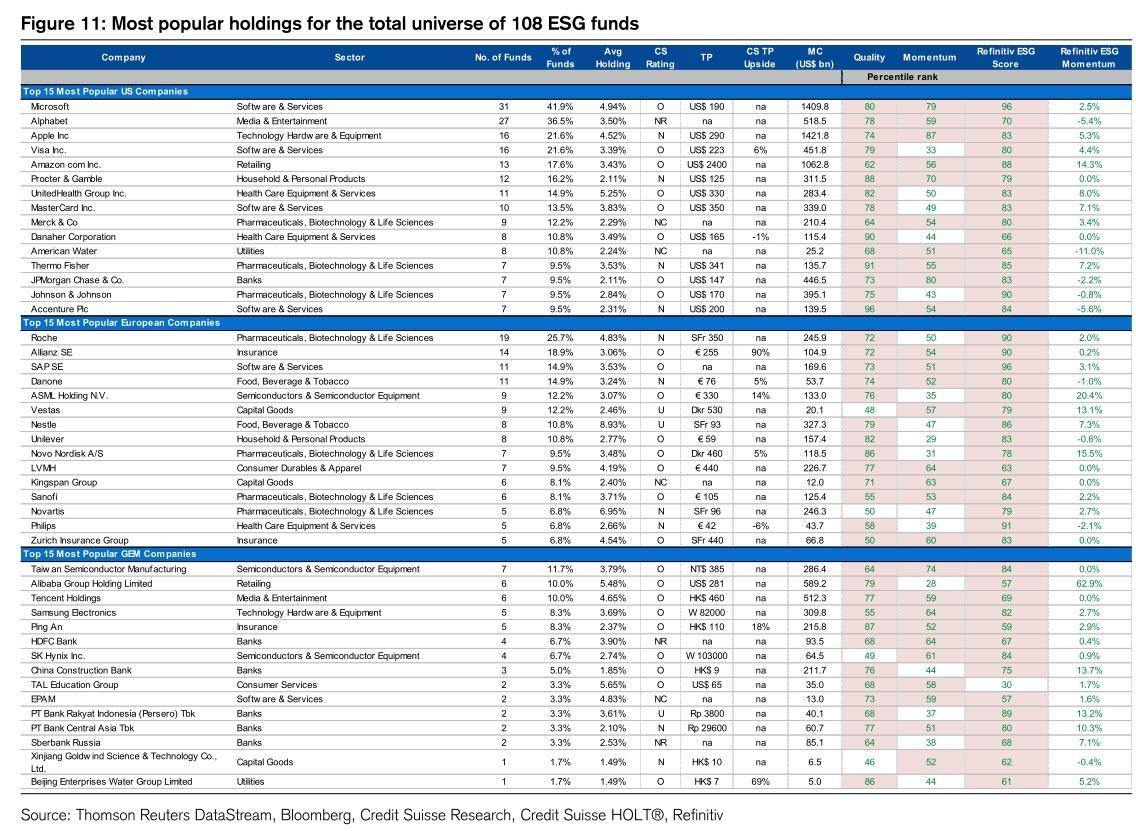

But as the pace of growth in terms of assets dedicated to "ESG" funds started to accelerate, we started to notice that the assets being stuffed into these ESG funds didn't really look all that different from a typical equity fund. Just take a look at a list of the most popular holdings from last year.

Now, take a look at the top holdings for ESGG, one of the top ESG-focused ETFs....

....MUCH MORE

Dec 2020

Knowledge@Wharton:: "Why ESG Investors Are Happy to Settle for Lower Returns"

March 2021Warning: Because there is a paucity of alt-energy stocks that don't rely on cobalt mined by children in the DRC (for example), certainly not $30 trillion worth, the vast majority of equities touted as ESG by the marketeers are tech stocks.

In part this is because the Google's of the world can claim energy efficiency by talking revenue per kilowatt of electricity used or carbon neutrality because their data centers use hydro-produced electricity or because they don't have smokestacks that some ambush photojournalist can snap pictures of or, whatever.

What this means in practical terms is that when you buy ESG you are buying growth and hypergrowth stocks. Meaning that if there actually is a rotation to value/small cap/other factors etc,. ESG is going to lag, possibly dramatically and ESG investors had better be resigned to underperformance for a long time, and possibly until behaviors are mandated by force of law..

This isn't where the below piece is going but is something that should be top-of-mind any time the subject comes up....

"Why the Biggest U.S. ESG Fund Has No Direct Renewable Holdings"

We've covered some of this ground in prior posts, links below....

September 2020

Professor Damodaran: "Sounding good or Doing good? A Skeptical Look at ESG"

October 2018

Some Thoughts on Environmental, Social & Governance Investing (ESG)

It is still an open question whether ESG investing is more than marketing/packaging by asset gatherers.

And beyond that, it is still an open question whether ESG is a rational approach to achieve the stated goals of its proponents....

Here's our general thinking on the phenomena, from the introduction to January's "The Inherent Conflict Between ESG and Passive Investing" which looked at one of the anomalous facts of the biz:

Over the last couple years we've seen investment shops embrace both passive investing and the Environmental, Social And Governance (ESG) criteria in their marketing material and to a somewhat lesser extent in portfolio construction.

Our typical reader is already way ahead of me on this: going ESG means, by definition, you're not passive and, by definition, going passive means you're not ESG. It's a tautology; it is what it is.

In June 2017 Matt Levine at Bloomberg View had some related thoughts on index construction and the Governance part of ESG that I've been meaning to post but first, just so our position is clear, we have not seen any academic research that overturns the findings of the Marcin Kacperczyk (now Imperial College London) and Harrison Hong (now Columbia) paper "The price of sin: The effects of social norms on markets" which we headlined way back in 2007 as:

Moral Judgment On 'Sin Stocks' Means Higher Returns For Vice-Friendly Investors

Until ESG can be shown to, at minimum, equal broader indexes over time (not just for a quarter or a year as sometimes happens) our chosen approach is to pursue the vice afforded by broader exposure and use the excess returns for whatever do-gooder projects strike one's fancy.

It's a variation on John Wesley's Sermon 50, The Use of Money (1744) which contains the admonition:

So, with Wesley thundering in our ears....

You know the drill: 'search blog' box, upper left