We'll be back later today or tomorrow on the ice in the Bering and Chukchi seas, last mentioned in February's "Shipping/LNG: 'Novatek Wants Arctic Sea Route Open Year Round'"

That may be a tall order over the next few years.And the headline story from OilPrice:

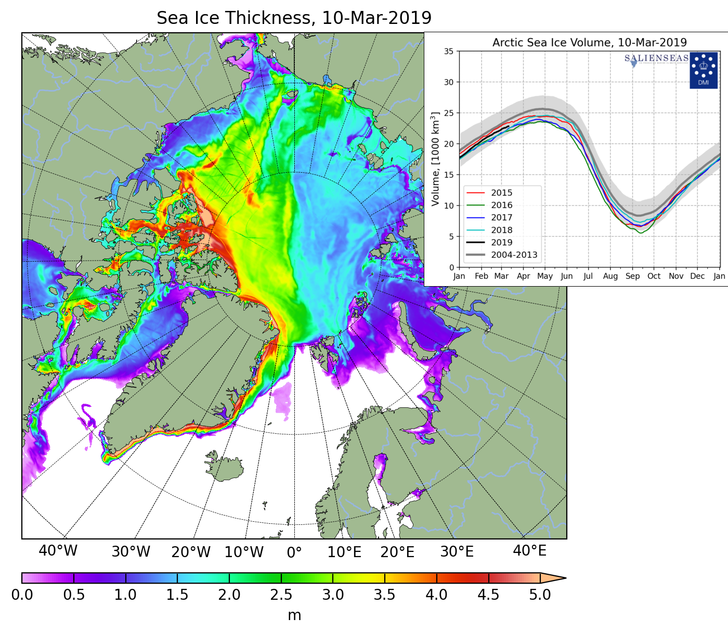

Despite the return of the troubling thin ice in the Bering and Chukchi seas—top center in this DMI map:...

Russia has long been established as a crucial component of most European natural gas import portfolios, with most imports received via pipeline through the Yamal-EuroPol pipeline (Poland) or the Baumgarten gas hub (Austria).

However, in the month of February, Russian LNG flows played a pivotal role in price formation within Europe. Many analysts have attributed the increased dependence on Russian LNG imports to the combined factors of weak Asian demand, driven by unseasonably warm winter temperatures, and the earlier-than-anticipated start of the Yamal LNG project. This article reviews whether this is an anomaly, or, if it is the ‘new normal’, and the potential ramifications for European natural gas security.

The Yamal LNG project, a US$27-billion joint venture between Novatek, Total, CNPC and The Silk Road Fund, began operations earlier than anticipated, with the first cargo shipped on December 11th, 2017. Due to the April 2020 commencement date of Yamal term contracts, the early cargoes from the facility are mainly being sold on a spot basis in the markets with the highest netback, which is currently Europe, according to Mark Gyetvay (CFO, Novatek PJSC).

Whilst Gyetvay attributed the increase in European LNG imports to ‘the warmer weather’ at the IP Week Conference, he added that “once the term contracts come into play, you get a better sense of where the trading operations are”, indicating that this is an anomaly, not the ‘new normal’ for the Russian export market.

Most of the Yamal LNG cargoes have been shipped to Northwest Europe this winter, becoming the main source of European LNG imports, providing both supply flexibility and, by extension, a cap on natural gas prices observed throughout Europe. This is mainly due to the dynamics observed within the Asian gas markets, typically the largest consumer of LNG. Following the tight spot LNG market last winter, Asian buyers secured sufficient supplies ahead of the winter, which has been unseasonably warm....MORE