The thing is, like a home-made Ezekial's Wheel, you keep thinking "this time, this time it will 'slip the surly bonds of earth'" but no, the damn thing always hits apogee and comes crashing back down....MOREThat was pretty lucky.

On the timing for the intro.

On the underlying observation, all glory and honor to Alphaville's Colby Smith.

Today's story is from Zerohedge:

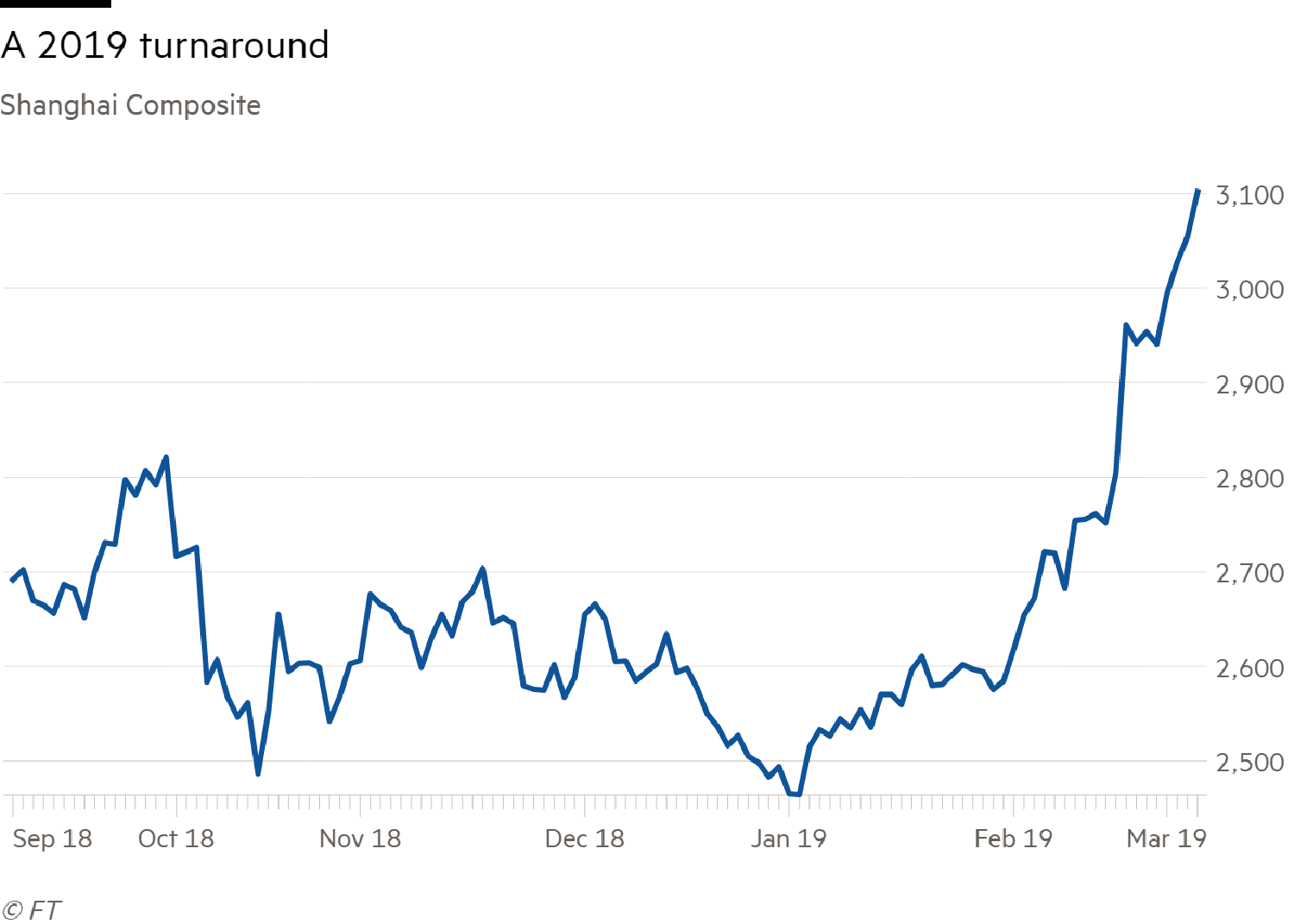

The question whether Beijing will tolerate another stock market bubble - one which it appeared to carefully cultivate until now - got an answer on Friday when Chinese stocks crashed, tumbling the most in five months. And it all started with a single sell rating.

The Shanghai Composite tumbled 4.4% to close below the key 3,000 point level, ending an 8 week rally, with the Shenzhen Composite and Chinext all following.

The drop was catalyzed by a limit-down plunge in state-owned insurer People’s Insurance Company of China, which had become a poster child of the ramp-up in equities, and which saw its shares sink by the 10 percent daily limit, after state-owned brokerage Citic Securities advised clients to sell the shares, saying they are “significantly overvalued” and could decline more than 50% over the next year.This was one of Colby's charts in yesterday's article:

The signal was heard loud and clear, and by the time the selling - which accelerated in the last hour of trading - was over as stocks hit lows at the close, the Composite had one of its worst days in years....MORE

I added the video of the Ezekial's Wheel.