Important note after the jump.

From ZeroHedge, Dec. 27:

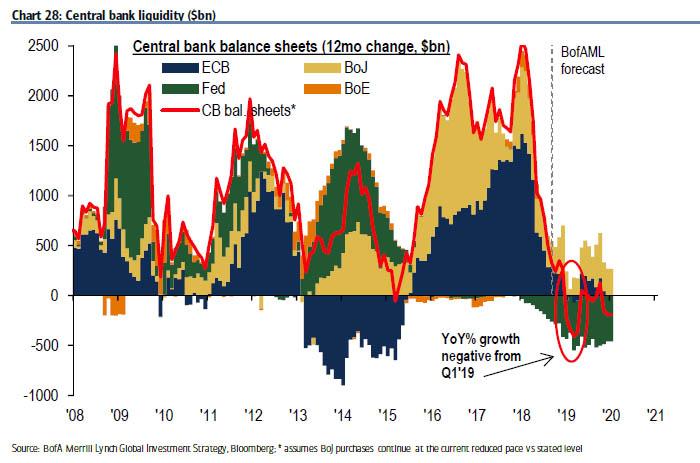

With traders finally accepting the reality that Quantitative Tightening means collapsing liquidity, tighter financial conditions and - obviously - lower asset prices, especially in the aftermath of Powell's "autopilot" comment regarding the Fed's balance sheet runoff which sent markets tumbling during the last FOMC meeting...

... Nomura's Charlie McElligott reminds us of his October call anticipating a "financial conditions tightening tantrum" which was based-upon the enormous "global QT impulse" that month (and which proved to be accurate) for one simple reason: January 2019 should see similar "tightening" as the Fed’s balance-sheet run-off continues (including two heavy weekly QT periods during the first- and third- weeks of January). And that's not all: in a world of fungible global liquidity, January will be hit with the double whammy of it being the first month following the cessation of the ECB’s bond-buying program.

So for those who - correctly - view the shrinking Fed balance sheet as one of the most important drivers of (declining) asset prices, and who also expect a self-fulfilling prophecy to emerge as traders avoid buying stocks on major QT days (which would likely result in aggressive selling) here is the calendar of January - and 2019 - days that have the largest balance sheet shrinkage, courtesy of Nomura's George Concalves. Will it be right? We'll know as soon as the first trading day of 2019, when $18.2BN in TSYs are set to mature.

Putting the Fed's projected balance sheet shrinkage in context - assuming of course Powell doesn't fold to pressure and halt QT - this is how the Fed's asset shrinkage will look like in 2019....note: the transmission effect of allowing the instruments to mature is not nearly as instantaneous as the opposite action of open-market purchases. In the case of a roll-off the treasury (or Fannie and Freddie) simply pay the Fed cash for the maturing amount. It is not as if the Fed is selling into the market.

The actual effect would come in later Treasury (or agency) debt offerings when the size of subsequent auctions would be increased to fund maturing debt, interest due and new deficits.

That may be why on January 2 the equity markets actually closed up a few DJIA points (18.78; S&P up 3.18) from the December 31 close.

However, the next day, January 3, the Down Joneses were off 660 points.

Whether there was any cause and effect I can't really tell, this stuff is all a brave new world experiment i.e. nobody knows but it is something to be aware of.

Additionally if there was causality the question for tomorrow and Thursday is: Will there be a difference between Treasury roll-offs and Agency issues?