We refrained from commenting on this IPO last month as we simply don't entertain new offerings.

That's not to say this won't have an impact, $200 million into a small market is going to shake things up a bit and if the rare earths frenzy of a few years ago (or uranium on the Salt Lake exchange in the '50's) is any indication there's some upside before a new battery technology or an innovative manufacturing technique causes the hot money herd to move on.

As always, as far as speculative vehicles go, we prefer futures where available, and on the blog, directional bets.

If you get those right the rest of the financial engineering stuff is a bit easier.

From Reuters:

(The opinions expressed here are those of the author, a columnist for Reuters.)

By Andy Home

Wanna buy into one of the hottest commodities in town?

No, it's not lithium. That's so much last year's thing. We're talking about cobalt. And this one's really hot.

On the London Metal Exchange (LME) the price for three-month cobalt has leapt from $32,750 per tonne at the start of January to a current $58,500.

This stellar near 80-percent price surge mirrors what happened to lithium prices a year or so ago.

The linkage is both metals' evolution from niche applications to mainstream usage in the batteries that are now powering the green technology revolution.

If a minimum $58,500 bet is a bit too much for you, some bright hedge fund guys have come up with a cheaper option.

For just nine Canadian dollars you can now buy a share in Cobalt 27 Capital Corp, which made its C$200 million ($150.7 million) debut on Canada's Venture Exchange last month.

Cobalt 27 describes itself as a "pure-play cobalt investment vehicle", an alternative to investing in producers such as Glencore, for whom cobalt is one small part of a much wider portfolio.

Just don't tell the automotive guys. Because if Cobalt 27 is right in its assessment there is much more upside to the cobalt price, there's going to be some sort of reaction to a bunch of investors holding physical stocks of a strategic metal in short supply.

GETTING PHYSICAL

Cobalt 27 has used a sizeable chunk of its IPO proceeds to exercise options to buy a total 2,157.50 tonnes of physical cobalt. To put that figure into perspective, the United States Geological Survey (USGS) estimates global production of refined cobalt was 97,400 tonnes in 2015.

The metal will be stored in LME warehouses operated by C. Steinweg (Baltimore, Rotterdam and Antwerp) and the Vollers Group (Rotterdam).

A smaller part of the proceeds will be used to purchase royalties and cobalt streaming agreements from eight exploration-stage properties.

Seven are prospects in Canada, three of them operated by Palisade Resources Corp, and one in Vietnam, operated by Asian Mineral Resources.

The company's ambition is to add to this list.

In essence, Cobalt 27 will offer capital appreciation, assuming the price of cobalt does indeed rise, and cash flow from royalties.

The whole thing is the brain-child of Pala Investments, which describes itself as "a multi-strategy investment company focused on the mining and metals value chain".

Cobalt 27 Chairman and Chief Executive Anthony Milewski is also a managing director of the Pala team.

Pala is the largest shareholder with 19.64 percent at the time of the IPO, although the stake may have fallen slightly as an over-allotment option has since been partially declared.

Part of Pala's holding represents payment for the supply of 626 tonnes of cobalt under one of the physical supply options.

Pala was one of several funds to have scooped up physical cobalt last year, which was when the metal first emerged from the specialist shadows into the investment limelight.

Another was Green Energy Metals Fund, part of the Portal Capital investment group, which is the second-largest shareholder in the new public entity having also supplied physical metal.

Not all of the cobalt sellers chose to convert to Cobalt 27 shares. According to the company's final prospectus, "a total of 961.9 metric tonnes of cobalt are being acquired for cash".Our most recent post on the blue stuff was June 29's:

But Pala and Portal evidently think there is more to come from the cobalt story.

THE ONLY WAY IS UP?

Or to quote Cobalt 27's prospectus, "the company believes strong cobalt demand, coupled with challenged supply due to a lack of primary cobalt mines and political instability in the Democratic Republic of Congo, which is the largest supplier of mined cobalt, creates an attractive proposition for cobalt price appreciation."

This is a market that is widely viewed by analysts as being in transition from a state of supply surplus to one of shortfall.

And as Cobalt 27 is happy to remind us, "in 2008, during the last multi-year cobalt supply deficit, the price of cobalt exceeded US$50/lb". That's equivalent to just over $110,000 per tonne.

There are any number of uncertainties in trying to forecast the price in such a fast-evolving market as cobalt, or lithium for that matter.

Everyone agrees that the electric vehicle revolution has arrived but beyond that there is no consensus as to how fast it might evolve.

And what sort of batteries will those vehicles use?...MUCH MORE

The Cobalt Trade Worked Out, On To Ruthenium

FT Alphaville's Kadhim Shubber took over the Further Reading chores today and linked to a story in this month’s American Economic Review on the violence that often accompanies the mining biz.

Here's "A “dark side” to the commodity boom in Africa" which, of course reminded me of something, in this case Presidential Executive Order 13712 of November 2015, which begins, in part:

I, BARACK OBAMA, President of the United States of America, find that the situation in Burundi, which has been marked by the killing of and violence against civilians, unrest, the incitement of imminent violence, and significant political repression, and which threatens the peace, security, and stability of Burundi, constitutes an unusual and extraordinary threat to the national security and foreign policy of the United States, and I hereby declare a national emergency to deal with that threat. I hereby order:...Bet you didn't know about that one huh?

Anyway, in 2015-2016 we had a series of posts on a trade to capitalize on Tesla's battery ambitions that we hoped would go beyond the "common knowledge" lithium action (which we had covered here on the blog for the prior ten years):

Why the CIA Reads The Financial Times (and you should too) Tesla and Cobalt

"Freeport Sinks On Sale of Africa Copper Mine To Chinese" (FCX; LUN.TO)

DR Congo’s State Mining Company Submitted An Offer to Buy Freeport McMoRan's Stake In Tenke Fungurume Copper, Cobalt Mine (FCX; LUN.to)

"Electric-car makers on battery alert as hedge funds stockpile cobalt"

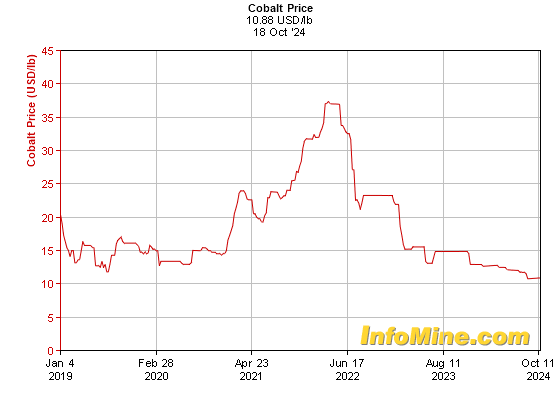

Here is the last couple years of price action for U.S. cobalt: